Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

DOHA, Qatar — She knows her way around a piece of cloth.

Sheikha Mozah bint Nasser al-Missned, mother of the current Emir of Qatar, is not educated in fashion, at least not formally. But when she's meeting with her brands — held under the umbrella of Mayhoola for Investments, the secretive fund that backs Valentino, among others — her keen eye and accumulated knowledge is on full display. Not only in the way she presents herself in waist-cinching, jewel-tone garments and kohl-rimmed eye makeup, but also in the remarks she makes about a fabric treatment or a tailoring technique.

"She is passionate about fashion," says an executive who has done business with the Qatari royal in the past and spoke on condition of anonymity because of continued dealings in the country. "And she's powerful. People follow her." Along with abundant capital, these qualities have played a pivotal role in the formation of Mayhoola, which under her widely known but technically undisclosed stewardship has quietly become a serious contender in the global luxury market.

Dozens of companies have tried over the past decade to form luxury groups that could rival the "big three" — LVMH, Richemont and Kering — yet few have succeeded. Labelux, the group that included Jimmy Choo and Bally, has been disassembled by German conglomerate JAB Holdings, which subsequently pivoted away from luxury goods altogether to focus on food. In Italy, there is Renzo Rosso's OTB Group, which owns Diesel, Maison Margiela, Marni and others, but it is much smaller than its French and Swiss rivals. Last year brought the inception of Tapestry, a US group that currently includes Coach, Stuart Weitzman and Kate Spade New York, with more acquisitions likely on the horizon. Most recently, Michael Kors acquired Jimmy Choo from JAB with the aim of building a rival American luxury group. But none of those entities conjure the gravitas and momentum of Mayhoola, which did not respond to request for comment via email or phone.

ADVERTISEMENT

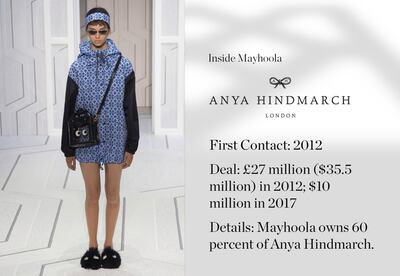

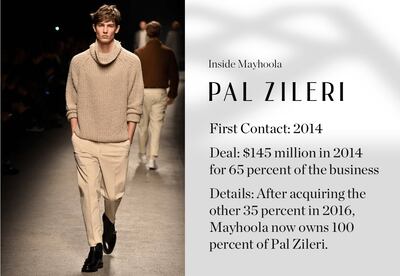

Started in the late aughts with only $25 million in seed funding, Mayhoola's portfolio now includes Valentino Fashion Group, which it bought in 2012 for about $850 million; Balmain, which it bought in 2016 for an estimated $620 million; Anya Hindmarch, in which it took a small stake in 2012 and now owns 60 percent; and menswear brand Pal Zileri, in which it first acquired a $145 million stake in 2014 and then acquired outright for an undisclosed sum in 2016. Mayhoola is also the second-largest shareholder in Boyner, a Turkish holding company that owns the luxury department store Beymen, which is reportedly seeking a public flotation, according to December 2017 and January 2018 reports. (It paid $332 million for a 30.7 percent stake in 2015, then another $46.2 million in 2017 to up its stake to 42.7 percent.)

Altogether, Mayhoola has invested roughly $2 billion in brands. Most recently, multiple reports have surfaced that the Qatari group is battling it out with Chinese conglomerate Fosun to acquire the near-bankrupt French fashion house Lanvin, in which it has shown interest previously. BoF has confirmed that Mayhoola is in talks with Lanvin, according to a source familiar with the matter who asked for anonymity because of ongoing discussions. (Representatives from Valentino, Balmain, Anya Hindmarch and Pal Zileri declined to be interviewed for this article.)

And, according to multiple sources, Mayhoola intends to sign on several more brands, with financing connected to the Qatari Investment Authority, the $335 billion sovereign wealth fund established in 2005 to manage the small-but-wealthy country's income from sales of liquefied natural gas, of which it is the world's greatest producer. Others say that Mayhoola is funded directly by Qatari private individuals, some of whom are members of the royal family, although it is challenging to distinguish the difference between what is private money and what is public money, given that the family and the government are one and the same.

The Qatari group is on the verge of acquiring the near-bankrupt French heritage house Lanvin.

Over the past 13 years, the Qatari Investment Authority, which did not respond to a request for comment from BoF, has put money into everything from Porsche to Barclays Bank to Tiffany & Co. (It sold off its $417 million stake in the American jeweller in September 2017.) It also owns British department store Harrods, which it bought in 2010 from Mohamed al-Fayed for about $2 billion.

But while the sovereign wealth fund, which some claim to be the royal family's personal assets tied with an official government bow, has investments in nearly every sector, fashion — and, in particular, high fashion — has played a distinguished role, despite the royal family's reticence to discuss its ambitions in public.

The rise of Mayhoola

Mayhoola's roots go back to 2008 talks with Lanvin-owner Shaw-Lan Wang to acquire the French fashion house. The deal never materialised and, instead, Sheikha Mozah, the second of three wives of then-Emir Sheikh Hamad bin Khalifa al-Thani — the one he is said to have married for love and who has borne seven of his children — decided she wanted to start her own fashion brand to compete with the likes of Prada, Gucci and Louis Vuitton. To begin, she raised $25 million from the Qatari Investment Authority and hired Gregory Couillard, a French LVMH executive with expertise in watches and jewellery, to run the new business, called Qatar Luxury Group. (The family often creates new companies to nominally shield its investments from being directly associated with government activity.)

Under Couillard's supervision, with significant input from Sheikha Mozah, Qatar Luxury Group acquired French leather goods brand Le Tanneur, as well as properties in the hospitality space. The idea, said one executive, was to use Le Tanneur's "technology" — as in, its expertise in manufacturing and production — to build Qela, the new luxury brand it launched in 2012 that offered made-to-measure clothing, shoes, jewellery and leather goods. By 2013, it had opened a store in Doha with a New York City 6,200-square-foot outpost planned for 2014. But by 2015, it was clear that Qela would never take off, and the Upper East Side storefront it had secured remained empty. Couillard exited Qatar Luxury Group in 2014, and in 2017 it sold its majority stake in Le Tanneur to Tolomei, a French private equity firm.

ADVERTISEMENT

A source who works with the royal family who spoke on condition of anonymity because of the ongoing relationship says that it has taken a "pause" to restructure Qela, which it hopes to position on the same level as Dior, according to this person. "After seven years of investment, the French people from Qatar Luxury Group were terminated," said another source, who previously dealt with Sheikha Mozah. "What came out of it was Mayhoola."

But what brought about Qela's demise and Mayhoola's rise? Qatar's somewhat erratic strategy in the fashion sector is as much a story of geopolitical upheaval as palace intrigue. It just so happens that 2013 was the same year Sheikha Mozah's husband, the Emir Sheikh Hamad bin Khalifa al-Thani, abdicated the throne, making way for their son, Sheikh Tamim bin Hamad al-Thani. While the transition was bloodless, it was not without conflict. Just as Sheikh Hamad had overthrown his father in 1995, he was himself overthrown nearly 20 years later.

"They are very avant-garde, she and her husband. Fashion is too frivolous for other people in the country," said the royal family's former business associate, describing Sheikha Mozah and Sheikh Hamad, the former emir. "Not everybody is always happy about them."

The new emir, Sheikh Tamim, is far more socially conservative than his father. Critics of the regime believe his authoritarian stance is undoing some of the work that his father and Sheikha Mozah did to open up Qatar to global investment, creating a third hub in the Gulf region with ambitions to compete with Dubai and Abu Dhabi. (Locals admire Sheikha Mozah for her willingness to support and meet with regional designers and entrepreneurs — they say her door remains open.) And despite the growth and prestige of Mayhoola, Qatar's wider ambitions in the global fashion industry - to build their own internationally known brands — appear increasingly stifled as the country becomes more insular and less cosmopolitan.

Qatar's somewhat erratic strategy in the fashion sector is as much a story of geopolitical upheaval as palace intrigue.

While there have been concerted, public-facing efforts to attract more foreigners to Qatar under the new emir's reign, including offering some permanent residency, in many ways he has been far less welcoming to the expatriates who make up 88 percent of the country's population, which hit 2.6 million in 2017. Social media apps, such as Whatsapp and Skype, have been intermittently blocked and some travel restricted. Expats say that, under the previous emir, there used to be a more liberal approach to how foreigners were allowed to live in the country. Now, expats must follow the same or similarly strict rules as Qataris, making it hard for some to drive without a local license and plans to ban alcohol from stadiums during the 2022 World Cup, which is set to take place in the country. (While it is an offence to drink alcohol in public, licensed hotel restaurants and bars are permitted to serve it, and expats may buy alcohol with a permit.)

"The expat community went to work there and had big salaries; they were there to build up the country," explained the former business associate, an expat who lived in Qatar during the last decade. "They helped the [Qatari royal family] to grow companies, develop companies. But they don't need the expats anymore."

Much of this has to do with the current Emir's controversial foreign policy. Most notably, the country's alleged ties to terrorist organisations, including the Taliban, which is said to operate a diplomatic outpost in Qatar and some say was established at the bequest of the United States to conduct backchannel talks with the group. However, what truly rankles other Gulf States is the current Emir's alleged financial support of groups such as the Palestinian militant group Hamas and the Muslim Brotherhood in Egypt.

In June 2017, four countries — Saudi Arabia, the United Arab Emirates, Egypt and Bahrain — demanded that Qatar cut these ties, shut down its popular but controversial television station Al Jazeera and close a Turkish military base on its territory. Qatar refused and the gang of four blockaded Qatar's airspace and shipping channels, draining the country's funds (an estimated quarter of its wealth) as well as the cultural capital it has aimed to build over the past two decades.

ADVERTISEMENT

More recently, there have been threats of military action. In January 2017, Qatar's Defence Minister Khalid bin Mohammad al-Attiyah announced during a visit to Washington, DC, that the country had plans to expand the American Al Udeid Air Base, making room for 200 new housing units for US military officers and their families. The base, which is not permanent, is currently populated with about 10,000 US military personnel and serves as a hub for air operations in the region, including Iraq, Afghanistan and Syria.

Sanctions imposed against the country by Middle Eastern neighbours have significantly slowed trade, forcing Qatar to look for revenue elsewhere. "The Qatar Investment Authority has been selling off assets over the past couple of months as it had to support the domestic banking system and the national economy," explains Sven Behrendt, managing director of GeoEconomica, a consulting firm specialising in political risk. "Sovereign wealth funds in most cases have such a buffer function, shielding government revenues from risks. That does not necessarily mean that they stop buying, but they have to realign their portfolio to new geopolitical circumstances."

This doesn't necessarily spell the stunting of Mayhoola, however. Sheikha Mozah has tremendous influence on her son, even though, as a member of the old guard, she has recently taken a less public-facing role in Qatari life, relinquishing her previous responsibilities in the creative industries, for instance, to her daughter Sheikha al-Mayassa.

The anatomy of a new luxury group

Despite the fate of Qatar Luxury Group, Sheikha Mozah has long been committed to Mayhoola, which launched on the global market with the 2012 acquisition of the Valentino Fashion Group from private equity firm Permira for roughly $850 million. But she has been tight-lipped about the deal. The Qatari royals are happy to speak about their activities in education, philanthropy and sport, but luxury investments, according to people who know them, are not something they are comfortable speaking about publicly.

The company's investment strategy resembles the classic approach taken by luxury conglomerates like LVMH.

Mayhoola's discretion is also linked to its desire to minimise inbound inquiries as its notoriety for being an eager buyer grows. Since that first acquisition, the firm has acquired Italian menswear label Pal Zileri, British accessories maker Anya Hindmarch and Balmain, which it bought in 2016 for about $620 million, roughly 14 times its EBITDA at the time of the transaction. While it purchased Balmain outright, Mayhoola purchased a 65 percent majority stake in Pal Zileri in 2014, then the remaining 35 percent from Egyptian group Arafa Holding in 2016. With Anya Hindmarch, its approach has been more incremental. It first acquired 39.9 percent of the company for $36 million in 2012, raising its stake to 60 percent by 2017.

Thus far, Valentino, Mayhoola's crown jewel, has paid dividends. In 2012, the label was generating nearly $460 million a year in sales. By 2016, that number had exceed $1 billion, with sales up 12 percent from a year earlier and growth for the following 12 months estimated to hit double digits. Earnings before interest, taxes, depreciation and amortisation were about $256 million (at current exchange), up 14 percent from $225 million in 2016. Last March, Valentino chief executive Stefano Sassi projected sales growth for the year would once again reach double digits.

According to sources who have interacted with representatives from Mayhoola, the company's investment strategy resembles the classic approach taken by luxury conglomerates like LVMH. The firm is interested in brands with long-term value and is looking to different regions and categories — including jewellery and beauty — for new "non-cookie cutter" acquisitions. The strategy, according to multiple sources who have had dealings with Mayhoola, is to buy mid-size companies in a new category so there is room for error. While Sheikha Mozah and her team are said to be deeply involved behind the scenes, they are also "very aware of what they don't know," says one person who spoke on condition of anonymity because of ongoing business dealings.

When it finds a prospect, Mayhoola moves fast and bids high, making the fund an attractive partner, especially to a private equity firm like Permira, which is seeking a high, speedy return on its investment. (The Valentino deal took all of six weeks, said the source.) However, there is a lot of education and examination leading up to its decisions. "I believe that the priority of Mayhoola is to continue to focus on the development of Valentino and exploiting the potential of the recently acquired brand Balmain, rather than aggressively look for new acquisition targets," says Mario Ortelli, senior research analyst at Sanford C. Bernstein. "However, in case an interesting opportunity will arise in the market, I think they will examine it."

For the companies under the Mayhoola umbrella, part of the challenge is upholding the cloak of secrecy surrounding the operation while promoting its success. (Mayhoola, after all, is said to mean "unknown" in the local Qatari dialect of Khaleeji Arabic.) While the brands are generally mum regarding the relationship, Sassi has in the past talked about Valentino's transition from being owned by Permira to being owned by Mayhoola.

"The company was demonstrating that a successful story was possible and [Mayhoola] decided to come, to join, to buy Valentino, and to accelerate our trend," Sassi told BoF in 2014. "For fashion, it is crucial to have a shareholder that is really looking long-term. Fashion is not a mass market product. It's about creating a brand, creating a dream, creating a perception. And private equity [is] usually not that. By definition, it's looking short-term. And this is something that is not easy."

In September 2017, Hindmarch told The Daily Telegraph that an additional $10 million investment from Mayhoola — taking its stake in her business to 60 percent — would allow the accessories line to remain "wholly focused on growth and scale, rather than being fixated on the bottom line."

Part of the challenge is upholding the cloak of secrecy surrounding the operation while promoting its success.

A complex future

In late 2017, reports surfaced that Mayhoola was expected to float 25 percent of Valentino's shares on the public market. Companies often issue public shares in order to rapidly raise a significant amount of capital, which can help to fuel growth in new territories, expand into new categories, develop new technologies or make structural changes in systems (such as supply chain). But Valentino already has an investor with seemingly limitless funds. A public flotation could help to legitimise the group in the financial world, however. "2016 was an interesting year for Valentino because it reached over $1 billion sales," says MainFirst Bank AG analyst John Guy. "A public flotation could effectively highlight or validate the investment progress. It's a question of being respected and taken seriously."

Some analysts have speculated that Mayhoola may use the public flotation as a way to spin off the Valentino Fashion Group — which now includes Valentino and Valentino Red — into a parent company that will house its other brands. The name may even be changed to something entirely separate à la Coach Inc.'s transformation to Tapestry, allowing Mayhoola to remain relatively unknown and continue incubating brands until they are ready to join the public-facing group.

But given that unrest in the region has caused the Qatari Investment Authority to pull out of some of its major investments, it could also mean that Mayhoola is tightening its purse strings. In the past, Mayhoola has often won brands by paying above market value, easing any concerns about the political situation in Qatar by making offers that were hard to refuse. (Lanvin, to be sure, will be a relative steal, even with Fosun as competition.)

As Valentino preps for a potential public flotation in 2018, Sassi has been quietly overseeing the entire group, with former Marc Jacobs chief executive Sebastian Suhl joining Valentino as managing director of global markets in November 2017.

Mayhoola has often won brands by paying above market value, easing any concerns about the political situation in Qatar.

But as Mayhoola's role in the global luxury market expands, the group may be forced to more openly reckon with the unrest currently unravelling Qatar, even if it creates another public-facing entity led by Sassi and operating outside of its official authority. In July 2017, Sheikha Mozah's nomination for a prominent Arab women's award was withdrawn after the Qatari opposition coalition alleged that millions of Qatari riyals were transferred from her bank account to members of the political opposition in Saudi Arabia and Kuwait, according to a report in Egypt Today. Sheikha Mozah supporters, however, insist that the slight is a pretext to ostracise her from a regional event in the same way the other Gulf countries have blockaded Qatar over the past year.

"Mayhoola on paper is of course not a government fund, but rather a fund run by the royal family. As such, its function is not to support public finances and therefore does not have the buffer function that the Qatar Investment Authority has," notes GeoEconomica's Behrendt. "On the other hand, it is obvious that Mayhoola's investment decisions will reflect the geopolitical circumstances that Qatar finds itself in right now."

In this way, Mayhoola's silence may benefit its investments. If this new, publicly floated group is seen as a separate entity, the brands that fall under its umbrellas are in some ways — intellectually, if not financially — detached from the source, and outside investors may feel more comfortable joining the party. Especially if Valentino's bottom line continues to swell.

Updated 3:30 pm GMT on 12 February, 2018:

After the publication of this story, market reports suggested that Chinese conglomerate Fosun has won the bidding contest for Lanvin. According to these reports, Fosun will invest more than 100 million euros into the beleaguered heritage brand, although Lanvin has yet to confirm the deal.

Related Articles:

[ What Qatar's Diplomatic Rift Means for FashionOpens in new window ]

[ Op-Ed | High-Fashion is a Good Fit for QatarOpens in new window ]

[ Why Would Mayhoola Pay Such a High Price for Balmain?Opens in new window ]

The FTC argued at an eight-day trial in New York that the merger would eliminate fierce head-to-head competition between the top two US handbag makers.

The Birkin bag maker reported a hefty rise in third-quarter sales on Thursday, continuing to outperform rivals hit hard by a sharp slowdown in luxury demand.

Sales at the French group fell 16 percent in the third quarter as a market-wide downturn hit hard. At flagship brand Gucci, where revenue fell 25 percent, management is exploring store closures while betting on a revamped handbag programme to jump start demand.

The tie-up between the French couture giant and the Hindi film star comes as luxury executives eye India’s high growth potential.