Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Opens in new window

Opens in new windowOne lasting impact of the Covid-19 pandemic has been soaring consumer interest in healthier lifestyles and nature-focused activities, like camping, hiking and boating. In the US, 82 percent of people said they had participated in such outdoor activities, compared to 60 percent in 2020, while nearly half of survey respondents in the UK report spending more time outdoors than prior to the pandemic. In China, by the end of 2021, more than 400 million people were taking part in outdoor sports, and between 2021 and 2023, the search volume in for “outdoor” on Chinese marketplace Tmall surged more than 600 percent.

This is, of course, good news for outdoor sportswear brands, many of which have also been riding the “gorpcore” trend that has picked up steam over recent years. “Gorpcore” is a colloquial term for trail-running mix (Good Ol’ Raisins and Peanuts). Outdoor enthusiasts and young urbanites alike have been gravitating to gorpcore’s functional, outdoors-inspired fashion, such as shell jackets and hiking-style sneakers. In 2022, revenues for the outdoor category were 24 percent higher than pre-pandemic times, drawing attention of financial deal makers. Outdoor wear has been a highly active investment category since the pandemic, with deals involving brands and retailers like Moosejaw, Marathon Sports and Topo Athletic.

Many of the fastest-growing sports brands of recent years have roots in outdoor performance but have since transcended their core customer bases to attain widespread popularity. In July 2023, The North Face announced its 10th consecutive quarter of double-digit revenue growth, while Amer Sports, backed by a consortium led by Chinese sportswear giant Anta, has said it plans to scale Salomon and Arc’teryx, two of its brands that were born as niche ski and climbing brands, respectively.

A similar evolution is taking place with technical and trail running brands such as Deckers-owned Hoka and On, which found loyal customers within running communities before their innovative, high-comfort solutions found appeal with wider audiences. On reported a 69 percent year-on-year jump in revenue to $1.3 billion for 2022, exceeding analyst expectations, while Hoka is on track to hit $2 billion in annual revenue.

ADVERTISEMENT

Luxury brands also have a toehold in the outdoors. The North Face and Gucci collaboration, unveiled in 2021, was one of the first big tie-ups between luxury and outdoors. Since then, a wave of performance-influenced footwear collaborations have followed, including those from On and Loewe, Hoka and Moncler, and barefoot shoe maker Vibram and Balenciaga. In terms of apparel, Jil Sander and Arc’teryx collaborated on a collection of sportswear-infused mountain gear, while Adidas and Moncler created a capsule collection of puffers and track jackets. These partnerships have elevated gorpcore, while celebrities like Kendall Jenner and Bella Hadid have taken to combining high luxury fashion with outdoor wear and hiking shoes.

Mid-market brands have been heading outdoors, too: H&M’s summer 2023 “Move” collection featured water-repellent parkas and convertible hiking trousers, while Inditex’s loungewear and activewear brand Oysho launched hiking boots within its permanent range alongside a hiking collection for women. Free People similarly expanded its merchandise to include hiking sticks and trekking poles.

In the year ahead, brands are expected to forge ever-closer ties between style and utility as lifestyle brands deepen investment in the outdoors, and outdoor brands increasingly court fashion-focused customers. As such, outdoor specialists are likely to more closely align their products to everyday lifestyles. Merrell, which started as a purveyor of high-performance hiking boots, is among the brands to have developed lifestyle footwear, while Icelandic outerwear brand 66°North named Kei Toyoshima, a menswear design consultant at Louis Vuitton, as creative director in 2022 to enhance its appeal with broader audiences.

Meanwhile, luxury players from Dior to Burberry are moving from one-off outdoor capsules to permanent collections. Prada’s Linea Rossa technical line has recently been sported by style makers such as A$AP Rocky. In turn, outdoor labels have started to borrow from the luxury playbook by, for example, opening high-profile flagships and pop-up experiences that elevate their brands. This includes Arc’teryx’s latest flagship store in Osaka’s Shinsaibashi neighbourhood, which features the first Arc’teryx cafe with food inspired by the brand’s Canadian roots, as well as a Japanese menu.

However, as the gorpcore trend cools, brands may be challenged to shapeshift their outdoor offerings. Similar to how the “quiet luxury” aesthetic gained popularity as consumer interest in streetwear waned, “quiet outdoor” styles are likely to gain popularity in the year ahead, with consumer preferences shifting from flashy performance jackets and cargo trousers to elevated garments with minimal logos while still featuring technical fabrics.

Reflecting this dynamic, Arc’teryx chief executive Stuart Haselden said in spring 2023 that the company is investing in sub-brand Veilance to cater to consumers looking for fashion-forward yet minimalist technical clothing without the typical gorpcore hallmarks. Outerwear label Goldwin has introduced simple, loose suiting made from ultra-lightweight wool and bamboo fibre, while Roa Hiking, a brand favoured by rapper Drake, has married a luxury aesthetic with functionality with products such as thermal-lined trousers made from water-repellent nylon fabric.

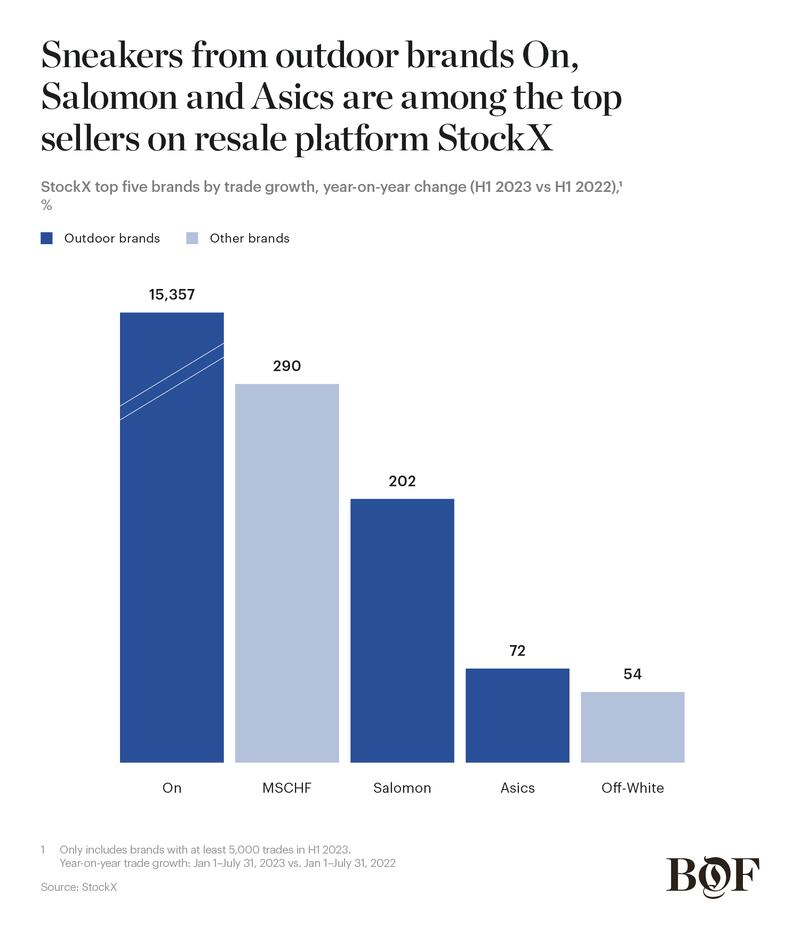

When it comes to footwear, outdoor-style shoes from performance brands that “sneakerheads” started coveting in recent years are likely to gain even more traction with consumers in 2024. On was the fastest-growing sneaker brand in 2023 on resale platform StockX, with trade activity up more than 15,000 percent year on year, while trade activity for Salomon and Asics was up 202 percent and 72 percent respectively.

This may spur brands to lean further into styles that straddle utility and fashion and can be worn in both urban and outdoor settings. For example, one of Salomon’s top sellers is its Sportstyle XT-6 Gore-Tex shoe, which features performance benefits but is designed for use in daily life. The brand has teamed up with Maison Margiela to launch an Autumn-Winter 2023 collection including a “Cross Wader” trainer which bridges technical performance and style, building on the success of the two brands’ “Cross Low” sneaker worn by Rihanna at the 2023 Super Bowl.

ADVERTISEMENT

In the coming year, utility, durability and performance may prove to be a good match for consumers’ budgets, increasing the appeal of the outdoor category. As such, brands across all price segments should get ready to embrace the outdoors in its new, blended form and find a place in the shifting competitive landscape.

Indeed, competition may increase across price points and categories, with some outdoor brands skewing apparel towards the high end (Arc’teryx, The North Face) and capturing some of luxury brands’ wallet share, while others look to further shake-up the footwear market (Hoka, On, Salomon). The challenge for all brands will be to establish relevancy among diverse customer segments, from technical outdoor-goers to StockX customers, while staying true to the brand’s core. Otherwise, brands may risk watering down their identities and losing what makes them distinctive in the first place.

For outdoor brands looking to conquer fashion, embracing a quieter aesthetic may be the key. On the other hand, fashion brands making their foray into outdoor wear may be able to crack the design code but may have to rapidly scale capabilities and suppliers to compete. Redefining the go-to-market strategy to prioritise innovation and extensive testing of materials for performance will likely become table stakes.

This article first appeared in The State of Fashion 2024, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company.

The eighth annual State of Fashion report by The Business of Fashion and McKinsey & Company reveals an industry navigating deep uncertainty. Download the full report to understand the 10 themes that will define the industry and the opportunities for growth in the year ahead.

The dream of creating an American answer to LVMH and Kering faced a major setback this week after a federal judge championed the Federal Trade Commission’s narrow definition of the sub-luxury handbag market.

The high-profile matchup between the New York Yankees and Los Angeles Dodgers has brands from both cities finding creative ways to take advantage, with or without an official MLB licence.

The British handbag maker will lay off around 85 people globally as it aims to chart a path back to profitability after fending off a takeover bid from billionaire Mike Ashley’s Frasers Group.

Businesses are responding to customer fatigue with price increases by shifting focus to more affordable products, reflecting a broader trend that may help curb inflation and support continued Federal Reserve interest rate cuts.