Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

After months of negotiating cloudy economic conditions, cautious buyers and strategics downsizing their portfolios, top-tier beauty assets found desirable homes in 2023. From masstige lines Mielle Organics and Naturium to higher-end labels Aesop and Creed and science-backed brands like K18 and Dr. Dennis Gross, companies proved that a strong mix of powerful brand identities, profitability and fast growth will be enticing to the right acquirer in any market.

Just days into 2024 and the market mood for beauty remains at fever pitch. Last week, Spanish beauty and fashion conglomerate Puig acquired a majority stake in Dr. Barbara Strum, and reports swirled that clean colour cosmetics brand Kosas is expected to go to market.

While some attractive targets like Augustinus Bader and Gucci Westman’s Westman Atelier’s are likely holding tight with an expected trade date of 2025, beauty brands of all shapes and sizes are eager to get their dues in 2024. Buoyed by the success of lines like Naturium and K18 (who went from launch to sale in under four years), the timelines for beauty labels to prove their theses has gotten shorter.

There are exceptions to that rule, of course, as labels like Kosas, launched in 2015, and Glow Recipe (which began acquisition conversations in 2022) explore sales. Skincare labels may have gotten their decks and bankers lined up, but it’s expected to be an even bigger year for cosmetics as a new guard of makeup lines are hoping to fare better than predecessors like Becca and Morphe, which sold in the late 2010s, when that category was last at a peak.

ADVERTISEMENT

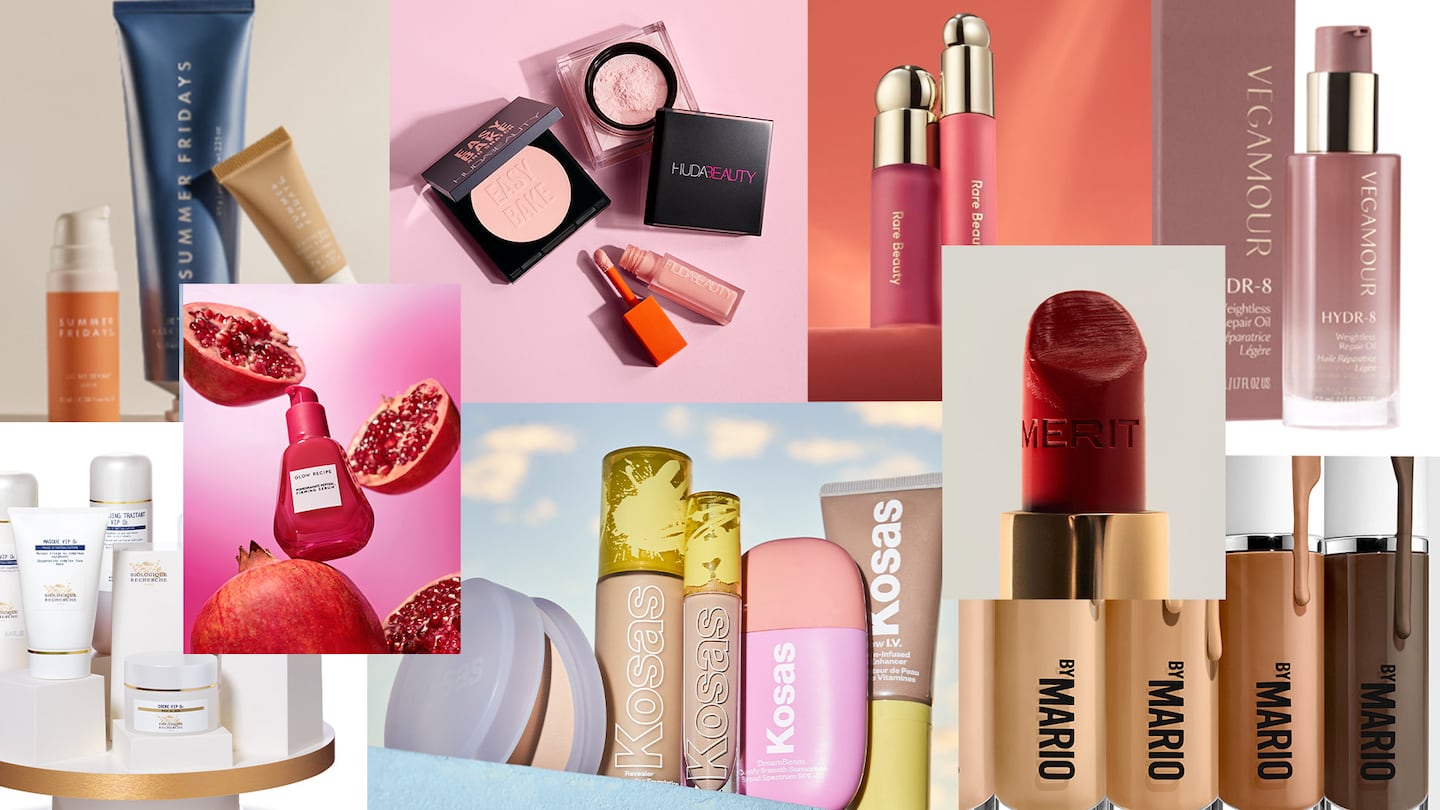

Ahead, nine beauty lines that are on buyers’ radars, according to industry executives, financial advisors, investors and market sources.

Kosas

2023 Estimated Retail Sales: $120 million

2024 Forecast Retail Sales: $150 million

The year is guaranteed to be a big one for makeup M&A as brands as varied as Rare Beauty and Milani receive inbounds from buyers. On the clean front, all lines are expected to take their shot from RMS to Saie, but it’s Kosas, created by Sheena Zadeh-Daly that is furthest along in its journey. Launched in 2015 with just four lipsticks inspired by a portrait painting class, Kosas has always had a “cool girl” vibe. But it’s the line’s focus on complexion products with skincare benefits that have created hits like its Revealer Concealer, which is made up of caffeine, arnica and hyaluronic acid. Traditional makeup lines have had a hard time selling skincare, but Kosas’ dual products like its DreamBeam sunscreen that offers a glowy tint and Wet Stick lipstick that gives users the glossiest of lips have had big fan followings, thanks to their productivity at Sephora. In the coming months, the brand is expected to make its push into Southeast Asia and the Middle East to solidify its global positioning.

Merit

2023 Estimated Retail Sales: $100 million

2024 Forecast Retail Sales: $150 million

ADVERTISEMENT

Though makeup artist brands like Westman Atelier and Makeup by Mario (more on that one in a bit) have brought a welcome dose of innovation back to the cosmetics aisle, three-year-old Merit prides itself on being a line made by and made for real people. Known for its “5 Minute Morning” makeup routine, the line, founded by Katherine Power, eschews the single hero product mantra commonly used by beauty brands, and instead touts several. Top sellers include its Minimalist Complexion Stick, Flush Balm blush and Solo Shadow eyeshadow, which launched late last year. Though stocked at Sephora, reportedly half of Merit’s business is done on its e-commerce site and average order value is well over $100. L. Catterton only took a stake in the business in Sept. 2021, but I wouldn’t be surprised if Merit found a home in the latter half of 2024.

Makeup by Mario

2023 Estimated Retail Sales: $225 million

2024 Forecast Retail Sales: $300 million

It was just a year ago that Mario Dedivanovic’s Makeup by Mario secured a $40 million minority funding round that valued the brand at over $200 million. In the time since, brand sales have exploded with revenue crossing the $100 million mark, thanks to the success of its SurrealSkin foundation and its follow up, the SurrealSkin Awakening Concealer, launched in August. With profitability at more than 30 percent, Makeup by Mario is a strong artist-driven asset, though some buyers might wonder what happens to the brand if Dedivanovic eventually leaves á la Bobbi Brown and Laura Mercier. Expect it in the market later this year.

Huda Beauty

2023 Estimated Retail Sales: $400 million

2024 Forecast Retail Sales: $450 million

ADVERTISEMENT

As one of the first influencers to build a beauty label, Huda Kattan’s Huda Beauty is reportedly preparing for its next phase of growth. TSG acquired a minority stake in Huda Beauty in late 2017, valuing the brand at $1.2 billion, and only holds onto lines for so long. The business is sizeable and has the potential to get even larger given its strong international presence. It has also reoriented around makeup (Kattan’s bread and butter) from skincare and fragrance. Though Kattan’s comments on the Israel-Hamas war have led to controversy online, sources say her business has only grown outside the U.S.

Vegamour

2023 Estimated Retail Sales: $140 million

2024 Forecast Retail Sales: $160 million

Now that K18 has sold, Vegamour is expected to follow. Launched direct-to-consumer by Daniel Hodgdon in 2016, the line has a wellness bent with topical products and supplements that centre on reducing signs of hair shedding and increasing growth, chief concerns for customers of all ages. General Atlantic purchased a minority stake in Vegamour in April 2021, and since the label has closely followed the prepping for an acquisition playbook: it launched in Sephora in 2021 and hired Robert Schaeffler, the executive who ran point on Devacurl’s sale to Henkel, in late 2022. Some sources say a brand sale could easily stretch in 2025, but with profitability metrics improving as Vegamour balances its omnichannel-DTC mix and marketing efficiency, a deal could happen sooner.

Summer Fridays

2023 Estimated Retail Sales: $150 million

2024 Forecast Retail Sales: $200 million

2023 was on track to be an banner year for influencers-turned-brand founders Marianna Hewitt and Lauren Ireland — around this time last year, Last year, I reported that that Summer Fridays was hoping for a 40 percent surge in sales to $70 million — but that was before the explosion of the line’s Lip Butter Balm, a skincare-colour cosmetics hybrid that evokes Lancôme’s cult Juicy Tubes but for Millennials and Gen-Z. Though the product launched in 2020 in a clear format, its extension into seven shades has not only driven sales volume but proven that the line is one that can successfully traverse categories, a key criteria for strategics today. (It even won the top lip prize at the Cosmetic Executive Women Awards in November over items like Dior Addict Lip Oil Glow.) The spike in sales also came from high productivity of other hero products like its Jet Lag Mask and ShadeDrops Mineral Milk Sunscreen.

The brand has also been on a hiring spree. Following the appointments of chief executive and chairman John Heffner and Kimberley Natale, president, in 2020, Summer Fridays has put its focus on filling key sales roles the last year as it hopes to grow its footprint globally.

Glow Recipe

2023 Estimated Retail Sales: $300 million

2024 Forecast Retail Sales: $390 million

Soon after the sales of buzzy skin care lines Youth to the People and Sol de Janeiro in late 2021, rumours swirled that Glow Recipe, founded by former L’Oréal executives Sarah Lee and Christine Chang, would be next. After engaging with investment bank Goldman Sachs and exploratory calls with buyers failed to secure an enticing offer in 2022, the founders reoriented around fundamentals, namely developing hero products and expanding internationally. The refocus has translated: the brand has roughly doubled retail sales year-over-year, according to sources familiar with the business, and is aiming for almost $400 million in retail sales in 2024. It is also reportedly the number one indie brand overall in all of Sephora and is a top five overall brand globally. Glow Recipe is a profitable, sizeable business; 2024 should be its year to cut a deal.

Biologique Recherche

2023 Estimated Retail Sales: $260 million

2024 Forecast Retail Sales: $300 million

Biologique Recherche, known for its cult P50 lotion, has been on buyers’ radars for years. But recently, its board and executive team has been reportedly more open to taking meetings with prospective acquirers — that’s expected to increase as new chief executive Jean-Guillaume Trottier joined the line this month.

But Biologique Recherche does have other strategic ambitions in mind in 2024, including opening new spas, buying out regional distributors and growing its China business, which could push a sale out to next year. There is no question that the line is beloved and clinical brands are winning — and with nearly 50 years of experience, it also has the heritage that newer competitors like Barbara Sturm and Augustinus Bader lack. But not all strategics understand the professional beauty channel which could be a challenge as an acquirer tries to take this luxury line mainstream.

Rare Beauty

2023 Estimated Retail Sales: $600 million

2024 Forecast Retail Sales: $750 million

Like I said, 2024 is the year of the makeup deal and there is no brand that shines brighter than Selena Gomez’s Rare Beauty. Revenue for the line reached $300 million last year, up approximately 50 percent from 2022, and is highly profitable. Multiple sources have said Rare is “flirting” with options, though the brand itself has stayed quiet. While Rare Beauty has yet to engage with a banker, buyers have been knocking down the brand’s door despite its association with a celebrity. Most sources say the products are so good and the line has such a high repurchase rate, it has traversed Gomez’s initial appeal. When a line gets this big independently, an IPO is often the next step and some have floated that could happen in 2025. But given the way that public markets have treated consumer brands (The Honest Company, Casper, etc.) a sale is likely a safer bet. Still, whoever buys the line has to have deep pockets; they’re looking at a $2 billion plus price tag.

Can sketch comedy sell makeup? Maybelline and E.l.f. Cosmetics are finding out.

L’Oréal’s dermatological beauty division is usually a blockbuster, but the impact of increased competition and the decline of drugstore distributors on its recent earnings show the company can’t rest on its laurels.

Since 2016, Kristin Noel Crawley has grown KNC Beauty slowly and steadily. Now, she’s ready for its big break.

The influencer-favourite brand seemed on rocket-like trajectory in the 2010s, culminating in a reported $3 billion valuation in 2018. But since then, trends have shifted, sales have slid, debt has mounted and its main investor, the private equity firm TPG Capital, is ready to move on.