Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

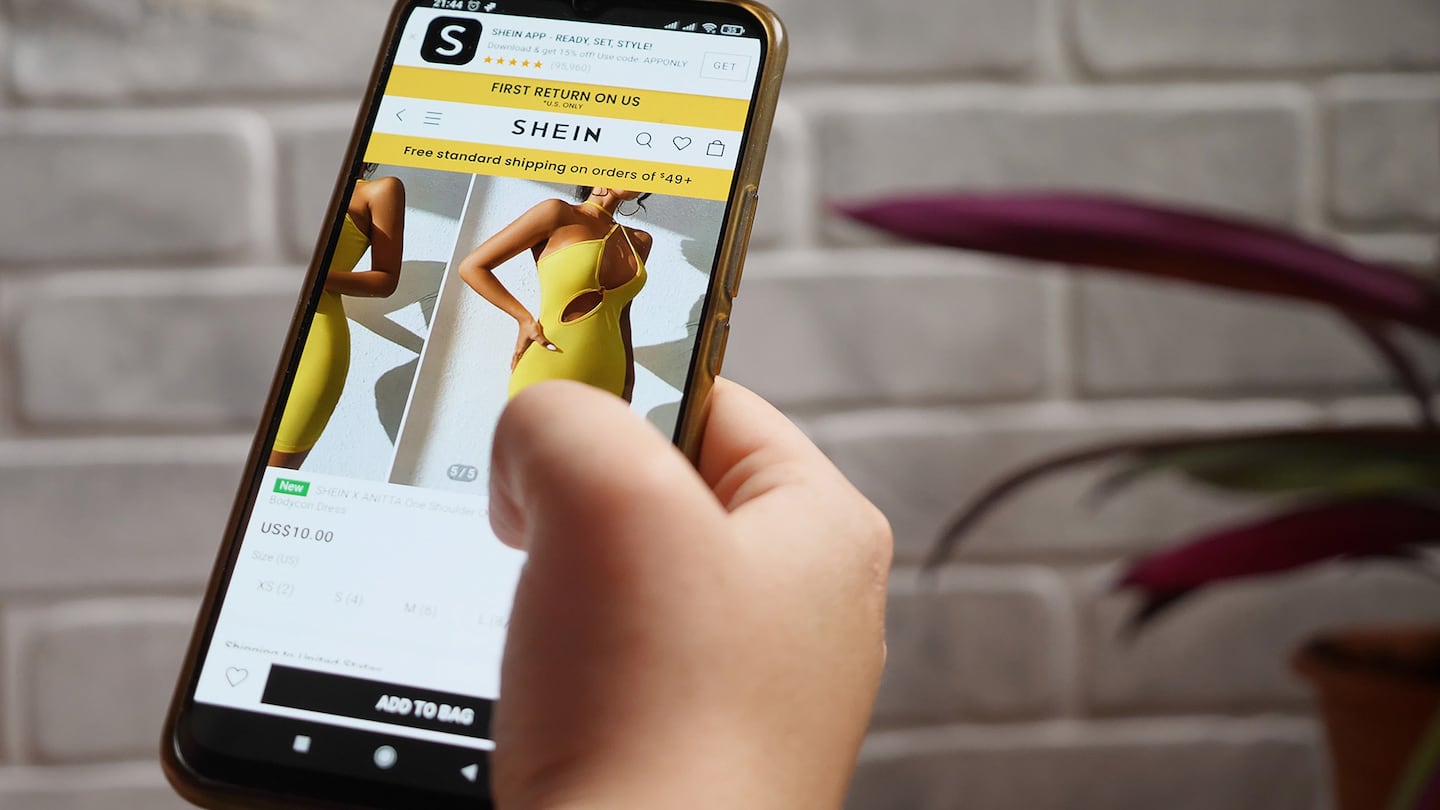

Sales of $10 tops and $15 dresses have sent the value of Shein, the Chinese-owned brand selling ultra-fast fashion to the West, soaring since it launched in 2017 in the US

Churning out thousands of new designs a day, Shein has a direct-selling model that targets its millions of social media followers.

The privately owned company, which is in talks with investment banks about a potential US initial public offering, according to Reuters, is valued at more than $60 billion.

In February, the Financial Times reported that Shein, headquartered in Singapore, made $22.7 billion in revenues last year, on a par with H&M, though below industry leader Inditex, which owns Zara. And Shein has no intention of slowing down, targeting revenues to more than double to $58.5 billion in 2025.

ADVERTISEMENT

Although another Chinese company with a similar model, Temu, is snapping at Shein’s heels, Shein is squarely in the sites of environmental campaigners, who see it as a prime contributor to the mountains of discarded waste textiles exported to countries in the Global South.

According to US/Ghanaian not-for-profit Or Foundation, one destination for waste textiles is Kantamanto secondhand market in Accra, which receives 15 million new garments a week. It said 40 percent end up as waste, often within one or two weeks, burnt in piles around the city, dumped in informal settlements or washed out to sea, where they contribute to microplastic pollution.

In an interview, Peter Pernot-Day, global head of strategic communications at Shein, defended the company’s record, and said it was working hard to reduce waste. The company already claims to have reduced waste from unsold clothes to “very low single digits”, and in some cases, below 1 percent , which Pernot-Day said was “unheard of” in the fashion industry, where such excess inventory is typically around 25 percent, but can reach as high as 40 percent.

It has achieved this through its “direct to consumer” business model, meaning that it produces items in small batches of 100-200 pieces, then uses digital technologies to analyse each item’s popularity with consumers, before ramping up production of top sellers to meet demand.

The lack of waste stock is the main reason Shein is able to offer goods in such a cost-competitive way, Pernot-Day said.

Last year, Shein committed to a fully circular supply chain by 2050. It unveiled a key element of its strategy in May this year, saying it will partner with US-based technology company Queen of Raw to rescue excess fabrics from brands and retailers to use in its own supply chain. The fashion industry produces vast quantities of excess fabrics and unsold products, the value of which grew to around $288 billion in 2022.

Pernot-Day explains that it will be able to match up so-called “deadstock” fabric with its production processes using its software, which enables it to function in a similar way to a vertically integrated company. “We will be able to admit entry to these next-generation fabrics at the mill level, and drive adoption across our contract manufacturing base,” he said.

Meanwhile, the software used by Queen of Raw, Materia MX, will enable Shein to track and report the impact of its use of deadstock in terms of the amount of carbon, chemicals and water saved.

ADVERTISEMENT

Shein and Queen of Raw have piloted the idea in the United States, selling products made from deadstock alongside other stock and without any specific labelling, according to Stephanie Benedetto, co-founder of Queen of Raw.

“They just lived on Shein, the way other products live. We wanted to test it and learn from it. One product sold out, and we’ve had five-star customer reviews about the fabric without us even telling them about its history,” she said. The impact of the pilot will be published soon, once the results have been audited, Benedetto adds.

In addition, Shein wants to produce more products from recycled fabrics, Pernot-Day said. Its EvoluShein by design standard requires garments to consist of at least 30 percent preferred materials, such as recycled polyester, and be produced by suppliers with high compliance with social standards, verified through third-party audits. Shein is aiming to roll the standard out to 50 percent of its products by 2030, he said.

Longer term, Pernot-Day said he would like to see the EvoluShein standard be further developed while accelerating recycling to promote full material circularity.

He pointed out that recycling of materials used in clothing is still in its infancy. Though Shein was “actively looking for partners in this space”, he adds that: “There is still quite a bit of work to do in taking synthetic fibres and being able to recycle them multiple times.”

On the issue of reducing post-consumer waste, Pernot-Day said: “To be totally candid with you, we haven’t completely solved that problem, but we’ve taken a number of very important steps towards our ultimate goal of full circularity.”

One of these is enabling customers to sell unwanted Shein clothes to each other via its website, he said. The peer-to-peer exchange has been trialled in the US, where one million users have signed up, and Shein plans to roll it out to other countries this year.

In response to criticism about fashion waste ending up in Global South landfills, Shein last year set up an Extended Producer Responsibility (EPR) Fund, to which the company will dedicate $50 million over the next five years.

ADVERTISEMENT

Liz Ricketts, co-founder and executive director of the Or Foundation, called Shein’s action “truly revolutionary” and an acknowledgement that its clothing may be partly to blame for Kantamanto’s problem. “We have been calling on brands to pay the bill that is due to the communities who have been managing their waste, and this is a significant step toward accountability.”

Others, however, have pointed out that the fund did nothing to prevent the problem in the first place.

Liv Simpliciano, policy and research manager at Fashion Revolution, which scored Shein a seven out of 100 on its annual 2023 Fashion Transparency Index, said that though direct-to-consumer models do reduce waste, “if you have an on-demand model done at scale, producing small amounts of thousands of styles, that is over-production by a different name.”

She added that the model could also lead to unpredictable order volumes, putting excess pressure on the supply chain, whose workers are already under immense pressure, to meet production quotas.

In the US, there has been congressional scrutiny of the direct-to-consumer model employed by the likes of Shein and Temu, alleging that it allows them to circumvent the Uyghur Forced Labor Prevention Act, which bans imports from China’s Xinjiang region, where materials such as cotton are often the product of forced labour by the Uyghurs, a mainly Muslim ethnic minority.

The same provision, known as de minimis, allows Shein and Temu to avoid import tariffs as long as the retail value of individual shipments does not exceed $800.

A coalition called Shut Down Shein has called on the Securities and Exchange Commission to deny IPO registration to Shein unless it shows it complies with the act.

In a statement, the company said: “As a global company with customers and operations around the world, Shein takes visibility across our supply chain seriously. Since entering the US market in 2012, Shein has been compliant with US tax and customs laws.”

Meanwhile, the impact of Shein’s programmes on its environmental record is yet to be seen. The company’s 2022 sustainability report contains little in the way of concrete targets and data.

Pernot-Day said that its ESG team has now developed a framework for reporting so that it can produce consistent data. “Hopefully, with the EvoluShein framework, we will be able to report overtime on these programmes and their success,” he said.

The company also wants to be “as transparent as we can” about its business, its challenges and its opportunities and successes.

Though Simpliciano backed the use of deadstock fabrics by fashion brands to reduce production-related waste, she pointed out that such strategies should be accompanied by plans to reduce the amount of clothing made from virgin materials.

“Using deadstock and more sustainable materials is great, but you cannot have these things and continue to mass-produce new items made from virgin materials,” she said. “That just signals as good marketing rather than a serious vested interest in slowing down fashion.”

By Catherine Early

Online fast fashion juggernaut Shein and SPARC Group — a joint venture between licensing firm Authentic Brands Group and mall operator Simon Property Group — have formed a partnership that could see Forever 21 clothing and accessories sold on Shein’s site, and Shein roll out shop-in-shops inside Forever 21 Stores.

Zoetop Business Co., the Hong Kong-based entity that previously owned Shein, is among the defendants, as is Shein Group Ltd., according to a writ of summons issued in July 2021 and recently obtained by Bloomberg News.

Fast-fashion giant Shein spent $600,000 on US lobbying efforts in the second quarter as it continues to face questions from lawmakers about forced labor and its opaque supply chain.

As the EU seeks to crack down on a growing glut of clothing waste, the rise of low-value ultra-fast-fashion, along with increased competition and geopolitical disruption, are putting pressure on the economics of collecting, sorting and recycling used textiles.

After a pandemic contraction — and with a new CEO on board — the godmother of mindful consumption is gearing up to grow (mindfully).

Cheap and versatile polyester has underpinned both the fashion industry’s growth and its worsening environmental footprint. Efforts to switch to recycled fibre are stalled, new data show.

This week, New York hosted the “unofficial climate summit of the year.” But the effort to move the needle on climate action feels as gridlocked as the traffic in midtown Manhattan.