Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

This article first appeared in The State of Fashion 2022, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company. To learn more and download a copy of the report, click here.

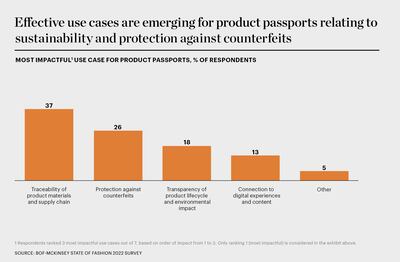

Fashion businesses are pouring investment into digital technologies that allow unique identifiers and other digital information to be added to products. These “product passports” link information that is valuable to both consumers and partners to individual products by leveraging a combination of technologies centred around blockchain and supported by the likes of radio-frequency identification (RFID), QR codes and near-field communication (NFC). Indeed, these technologies are helping businesses to tackle significant industry pain points, such as counterfeiting and the need for more responsible and transparent business practices amid rising consumer engagement with climate change and labour conditions in fashion.

Demonstrating progress in sustainability is particularly important in gaining the trust of younger fashion consumers, as some 43 percent of Gen-Zers say they actively seek out companies that have a solid sustainability reputation. One way to store and transparently share information on a product’s sustainability credentials is through technology-based product passports. This information could include details about the product’s materials (providing a more detailed and permanent record than traditional sewn-on labels), where and how it was made, and the working conditions at the manufacturer.

For example, Eon’s Connected Product Platform allows companies such as Pangaia and Yoox Net-a-Porter to create “digital twins” for their products and private-label collections respectively, containing information that can be updated in real time, such as details on a product’s provenance. Similarly, Reformation is partnering with blockchain platform FibreTrace to give customers QR-code access to information on the lifecycles of its denim garments, while TS Designs uses QR-enabled passports to certify garments are made in the US. Though product passports are not a silver-bullet solution to sustainability concerns — as companies still face the challenge of making sure the data they get from suppliers is accurate — they are setting higher standards for supply chain transparency and traceability for fashion.

ADVERTISEMENT

Product passports are also supporting circularity initiatives like resale and garment-to-garment recycling. In providing detailed data on materials, they facilitate easier collection and sorting of garments for recycling at scale. Like Eon, closed-loop recycling platform Circular Fashion has developed an open data standard that can be read by a variety of applications along the product lifecycle. The company has launched a pilot project with fashion brands such as Armedangels, as well as stakeholders in used clothes collection and sorting, to test applications for scaling garment-to-garment recycling (see “Circular Textiles”). Initiatives such as the European Commission’s European Data Space for Smart Circular Applications and the American Apparel and Footwear Association (AAFA)’s call for the digitisation of apparel and footwear labelling are also supporting these kinds of efforts.

“Consumers often remove labels from their garments, separating the garment from its legally mandated fiber content, identity, care, and origin information for the rest of its life,” wrote AAFA president and chief executive Steve Lamar in a 2020 letter lobbying the US Federal Trade Commission to support digitised labels in a technology-agnostic way. “[This] would reduce the likelihood that the information gets separated from a product. Consumers, even secondhand consumers, would have constant access to the information over the life of the garment, without having to sacrifice the comfort of the garment.”

The growth of resale businesses means it has never been more important to prove authenticity and track a product’s history, particularly in luxury.

The growth of resale businesses means it has never been more important to prove authenticity and track a product’s history, particularly in luxury. Analysis from the BoF Insights report “The Future of Fashion Resale” suggests that the resale market will reach $57 billion in sales by 2025, up from $27 billion today, while second-hand marketplace ThredUp estimates that resale will grow 11 times faster than the overall clothing retail sector over the next five years.

As resale grows, product passports will ease operational processes by offering readily available digital twins and standardised product information. These will support authentication and valuation, as well as streamline a process that was historically manual, reducing reliance on authenticator specialists who have been in significant demand on industry jobs boards. For example, one feature of Eon’s digital passport is to suggest the price of a garment based on its history, including who wore and owned the product, as well as repairs history and advice on marketing. Certainly, the digital authentication offered by product passports will help boost trust in second-hand luxury goods and collectibles, meaning resale platforms such as Vestiaire Collective and The RealReal stand to benefit.

Another application of product passports is in anti-counterfeiting measures. Valued at around $500 billion a year globally, counterfeiting generates more than 60 percent of that value from fashion and luxury goods. The China Certification and Inspection Group is among the organisations to be making strides in the battle against counterfeiting with product passport technology. Its “one item one code” technology allows customers to scan a code and see a simple confirmation of a product’s authenticity. Brands are similarly ramping up their efforts. Chanel is launching a digital passport to replace physical authenticity cards in its bags, which will be accessible through a scannable metal plate in the product. This will enable the brand and consumers to immediately recognise authentic products and ensure after-sales services such as repairs are only provided for genuine bags.

Initiatives to develop product passports are emerging in both private and open-source forums. The Aura Blockchain Consortium, a shared private platform launched by companies including LVMH and Prada in spring 2021, leverages unique codes to provide authenticated product records, including ownership history, product authenticity data and provenance of materials. When a customer buys a product, he or she receives an encrypted certificate containing information about the production process. In the open-source space, meanwhile, IBM and luxury and fashion non-fungible token (NFT) platform Arianee are partnering to pilot digital product passports for brands such as Swiss watchmakers Breitling and Vacheron Constantin.

In addition to supporting authentication and traceability, several brands are leveraging these product technologies to drive brand engagement, loyalty and repeat purchasing. Prada is rolling out NFC solutions to offer personalised information and purchasing suggestions to customers who scan NFC tags embedded in products with their mobile devices. Meanwhile, Paco Rabanne has launched its first NFC-enabled fragrance, which allows customers to access digital content such as interactive games and educational features by connecting their smartphone to an NFC chip, and Breitling is leveraging digital passports to share promotions with customers and demonstrate authenticity.

Looking ahead to 2022, a growing number of fashion brands are set to ramp up development of product passports across various B2B, B2C and C2C use cases. Pressure to establish supply chain transparency and adopt circular business models will fuel demand and help justify scaling pilot projects to mainstream applications. At the same time, the growth of luxury e-commerce and resale markets and the need for authentication will encourage adoption, either as part of a collective initiative (such as Aura) or independently (as with Chanel). While the cost of some product passport technologies has historically been a pain point in scaling, costs are coming down: the price of an RFID tag has fallen by 80 percent over the past decade.

ADVERTISEMENT

A success factor for widespread adoption of product passports will likely be the industry’s ability to establish common standards. “Brands are competitors, and there’s a lack of cooperation,” said Tyler Chaffo, sustainability manager at RFID labelling and supply chain solution company Avery Dennison. Currently, some digital passports only operate on closed platforms, while others are open-source and compatible across a range of applications. Still, there are signs that players are starting to converge around a few solutions, with Aura and Arianee frequently cited in many discussions.

Accessibility and affordability will also be success factors in the burgeoning product passport ecosystem. “It’s really important that there’s been a democratic process so we could create a governance structure and a standard that works for both smaller brands and big brands,” said Timothy Iwata-Durie, Cartier’s global innovation director and a member of the Aura board.

From a commercial perspective, product passports will deliver the most advantage to players that can expand their functionality across use cases. For those who get it right, passport technologies will reinforce consumer trust, create exclusivity, support repurchase and enable more sustainable and responsible practices. To encourage scaling, standardisation and compatibility should be top priorities. As these dynamics play out, the key for brands will be to keep pace with innovation and consider collaborations selectively to meet their business objectives.

Opens in new window

Opens in new window

The sixth annual State of Fashion report forecasts that global fashion sales will surpass their pre-pandemic levels in 2022 thanks to outperforming categories, value segments and geographies, while supply chain headwinds will pose a risk to growth prospects. Download the report to understand the 10 themes that will define the state of the fashion industry in 2022 and the strategies to deploy to safeguard recovery and maintain sustainable growth.

BoF Professionals are invited to join us on Dec. 8, 2021 for a special live event in which we'll unpack findings from the report. Register now to reserve your spot. If you are not a member, you can take advantage of our 30-day trial to experience all of the benefits of a BoF Professionals membership.

1. Navigating Fashion's Uneven Recovery

2. The Great Logistical Gridlock

3. Global Luxury Adapts to New Travel Trends

4. Consumers to Reboot Wardrobes for Post-Pandemic Life

5. Building Brands With a Metaverse State of Mind

6. Unlocking Next-Generation Social Shopping

7. Paving the Way for Closed-Loop Recycling

8. What Product Passports Will Do for Brands

9. Shoring Up Fashion's Cyber Defenses

10. A Talent Crunch Is Heading Our Way

As leader of the Aura Blockchain Consortium, Daniela Ott is tasked with persuading brands to join brands such as LVMH, Prada and Richemont-owned Cartier on the shared digital platform which creates ‘product passports’ for luxury goods.

Digital product passport technology could tackle counterfeiting, help brands meet regulatory requirements and unlock new sources of revenue and engagement. Michele Casucci, founder and GM of Certilogo and Robin Mellery-Pratt, BoF’s head of content strategy, gathered executives in Paris to discuss its potential.

The search giant is rebuilding its shopping experience around AI, rolling out new features like personalised product feeds and AI-powered shopping guides, beginning this week.

To boost sales and create a better customer experience, companies are revamping the e-commerce search bar to make it easier for shoppers to find products or even shop in new ways.

Concerns are growing that the technology’s transformative power has been oversold. Kamali, on the other hand, is as convinced as ever that, for her at least, it marks the start of a new creative era.