Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Opens in new window

Opens in new windowThis article first appeared in The State of Fashion: Technology, an in-depth report co-published by BoF and McKinsey & Company.

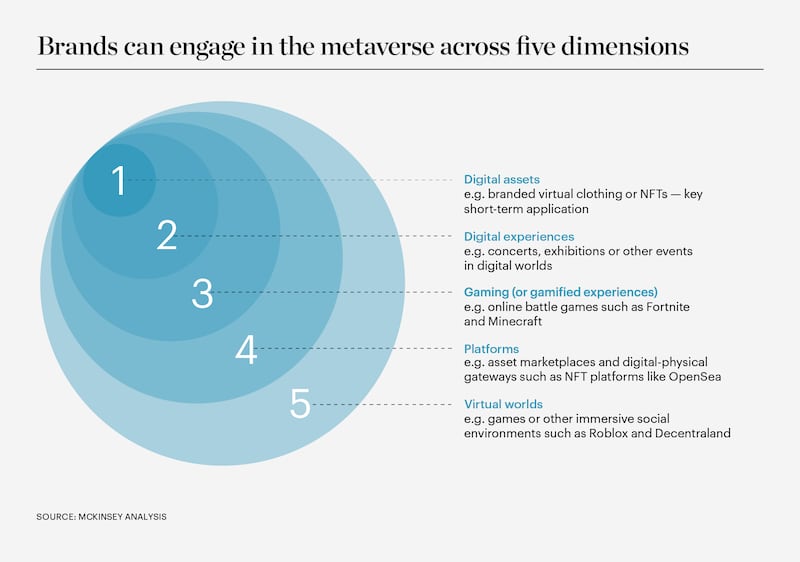

Pioneers in the metaverse have shown there is a business case for fashion brands to invest in virtual worlds. Granted, a fully formed metaverse — comprising an interconnected, virtual ecosystem that overlaps with or offers an alternative to physical reality — is not yet possible given technology constraints. But brands’ experiments with metaverse principles, such as virtual fashion, extended reality, gaming and non-fungible tokens (NFTs), demonstrate the impact that virtual activities can have as marketing and community-building tools for fashion. Global spending on virtual assets reached around $110 billion in 2021 and is expected to grow at roughly the same rate as the gaming market to be worth around $135 billion or higher by 2024.

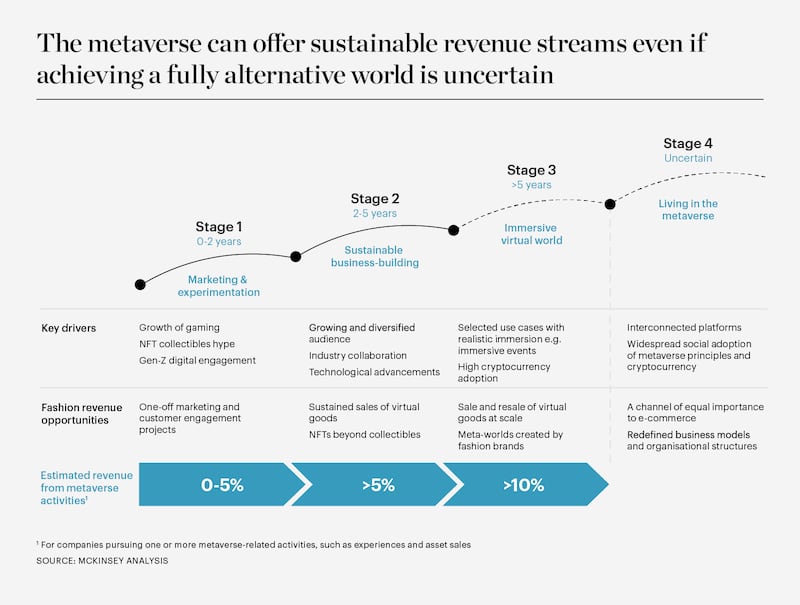

The next frontier for leading brands will be to translate unproven technologies into sustainable revenue streams, effectively separating hype from reality. Over the next two to five years, fashion brands focused on metaverse innovation and commercialisation could generate more than 5 percent of revenues by investing in virtual activities today.

Looking beyond a five-year horizon, some bullish observers expect mass consumer adoption of virtual worlds, creating the biggest opportunity for the fashion industry since e-commerce. The bears predict that the hype around the metaverse will fade as technologies fail to meet expectations or users prove reluctant to use virtual spaces as extensively as some business plans are counting on.

ADVERTISEMENT

While it is uncertain whether a meaningful number of consumers will develop fully fledged virtual lives and spend most of their time in the metaverse, significant revenue opportunities for fashion brands will emerge.

The pace of adoption will be driven by technological advancement, the interoperability between virtual environments and social acceptance. Tech players as well as fashion start-ups and brands need to develop technologies that help evolve today’s unrefined virtual experiences into mature, immersive realities. Mass consumer adoption could be a significant hurdle — 78 percent of people who have already ventured into virtual worlds say they miss physical interaction when doing so.

As a result, many players will likely hang back to see evidence of commercialised use cases and a tangible ROI before investing. For others that want to capture the commercial opportunity, the biggest short-term revenue potential lies with virtual assets that can be traded, transferred or used for payment. We identify two clear use cases for virtual assets that have long-term potential:

In virtual spaces and on social media platforms, the appetite for creating and adapting online identities is high: approximately 70 percent of US consumers from Gen-Z to Gen-X rate their digital identity as “somewhat important” or “very important.” A similar appetite for virtual goods can be found in China, where 70 percent of luxury consumers have purchased or will consider purchasing virtual assets.

Some companies are using augmented reality (AR), to enable users to alter photos and videos, and are creating digital skins to change the appearance of a user’s avatar. For example, digital fashion start-up DressX, which sells virtual clothing that can be added to a photo and posted on social media, has partnered with brands such as H&M to launch digital collections. Meanwhile, users on online gaming platforms such as Roblox update their avatars with new skins regularly, even daily in some cases. The potential revenue generation of in-game outfits and accessories can be significant. Gucci sold a virtual version of its Dionysus bag for the equivalent of $6 on Roblox, which later led to bids of more than $4,000 per bag when resold on the secondhand market.

The multi-billion-dollar gaming market will continue to offer opportunities for fashion — the market for gaming skins could reach $70 billion by 2024, up from $40 billion in 2020. Brands will need to turn to established gaming and platform partners to find inroads.

Over the next two to five years, fashion brands focused on metaverse innovation and commercialisation could generate more than 5 percent of revenues by investing in virtual activities today.

Still, as with any nascent technology, there are risks. For one, brands — particularly those in luxury — should be aware of selling “cheap” digital items that could weaken the exclusivity of their brand image. AR technology is at a relatively early phase of development, where glitchy or unwieldy applications can undermine the user experience.

Furthermore, if brands choose to partner with virtual platforms, in gaming or otherwise, the top-line opportunity may be dampened by high take rates, which could reach as high as 50 percent commission on revenues.

ADVERTISEMENT

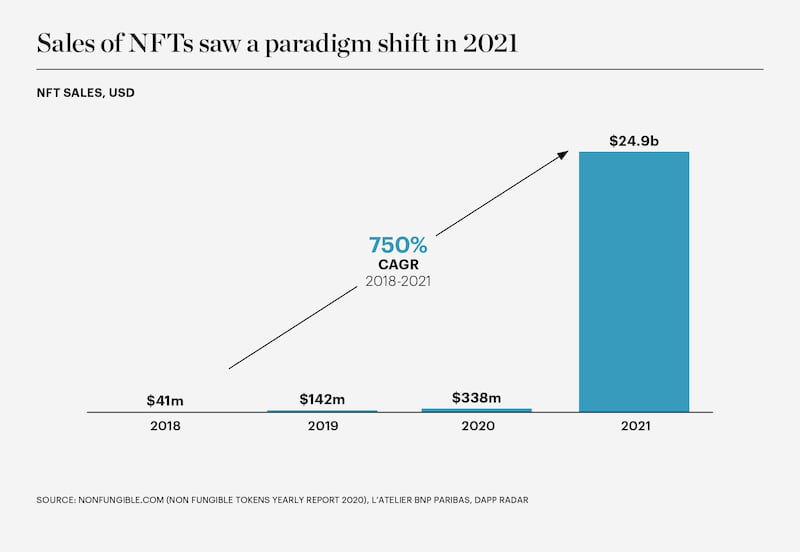

Much of the frenzy about blockchain-based NFTs has been centred around digital art collectibles, which are in some cases bought and traded for inordinate sums, driving news headlines as some observers scratch their heads. The compound annual growth rate of the value of the NFT market skyrocketed 750 percent between 2018 and 2021, from $41 million to $24.9 billion.

But the rapid rate of growth in NFT sales is already starting to moderate. Indeed, the daily trading volume on NFT marketplace OpenSea fell by 80 percent between February and March 2022. NFT sceptics suggest that this could indicate the bursting of a bubble in an unsustainable market with a limited number of active customers and rampant hoaxes and scams.

However, even as the hype subsides, use cases will emerge that address industry pain points and consumer desires with applications that support community building, product traceability and authenticity.

The long-term business opportunity for fashion brands to engage with NFTs will likely serve more pragmatic purposes by using NFTs as “loyalty tokens.” Gucci, Adidas and The Hundreds, among others, have used NFTs to offer benefits like early access to new NFT drops and physical products, essentially serving as a membership programme. In a sense, these NFTs are digital collectibles, since users cannot yet wear them in virtual worlds, though they could use them for social media profiles. Brands are starting to add more “utility” to collectible NFTs, which could make buying one more worthwhile to consumers and translate into a long-term opportunity for brands.

We see the most compelling use case for NFTs as digital twins that host information about a physical or digital product’s history, authenticity and ownership — something that is especially beneficial to the luxury segment in its battle against counterfeiting. Twins enable products to be paired with a theoretically tamper-proof record and unlock the ability for brands to collect royalties from resale. A host of start-ups and industry initiatives such as Aura Blockchain Consortium, Lablaco and Arianee are aiming to make blockchain-based digital twins commonplace. Lablaco is working to link its digital IDs to virtual versions of garments, so that customers can engage in augmented reality experiences such as try-ons.

While a few disruptors, such as marketplaces for digital fashion, will solely focus on virtual goods, most tech-savvy, innovative brands will tap the opportunity to diversify revenue streams and target Gen-Z and Millennial consumers. Players that want to experiment in the metaverse but lack the requisite in-house capabilities can:

Like the early days of e-commerce, some metaverse-related ventures are likely to fail outright or need rapid iteration. However, fashion is well placed to capitalise on the engagement with virtual worlds and the metaverse, owing to its connection to self-expression, status and creativity. Executives should consider metaverse strategies based on their companies’ digital ambitions and customer targets.

Opens in new window

Opens in new windowThe special edition of The State of Fashion report by The Business of Fashion and McKinsey & Company explores the great tech acceleration gripping the industry. Download the full report to understand the key imperatives that are spurring top brands and retailers to ramp up investments in technologies from AI to blockchain, to both address pain points and boost their competitive edge.

BoF’s Marc Bain chats with Lauren Sherman about the 3D creators, game designers and NFT experts bringing fashion into the virtual world.

There may be a better analogy than e-commerce to size up fashion’s metaverse opportunity: will it be more like streaming or 3D movies?

Digital product passport technology could tackle counterfeiting, help brands meet regulatory requirements and unlock new sources of revenue and engagement. Michele Casucci, founder and GM of Certilogo and Robin Mellery-Pratt, BoF’s head of content strategy, gathered executives in Paris to discuss its potential.

The search giant is rebuilding its shopping experience around AI, rolling out new features like personalised product feeds and AI-powered shopping guides, beginning this week.

To boost sales and create a better customer experience, companies are revamping the e-commerce search bar to make it easier for shoppers to find products or even shop in new ways.

Concerns are growing that the technology’s transformative power has been oversold. Kamali, on the other hand, is as convinced as ever that, for her at least, it marks the start of a new creative era.