Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Forever 21′s Shop City, a virtual experience launched by the fast-fashion retailer on Roblox at the end of 2021, is the digital equivalent of a dead mall.

On a recent weekday afternoon, the stats shown on its own Roblox page confirmed that not one of the game platform’s more than 60 million daily active users was inside. Shop City has averaged just a few dozen daily visitors over the last few months, according to Geeiq, a gaming research and strategy firm. Forever 21 did not respond to a request for comment.

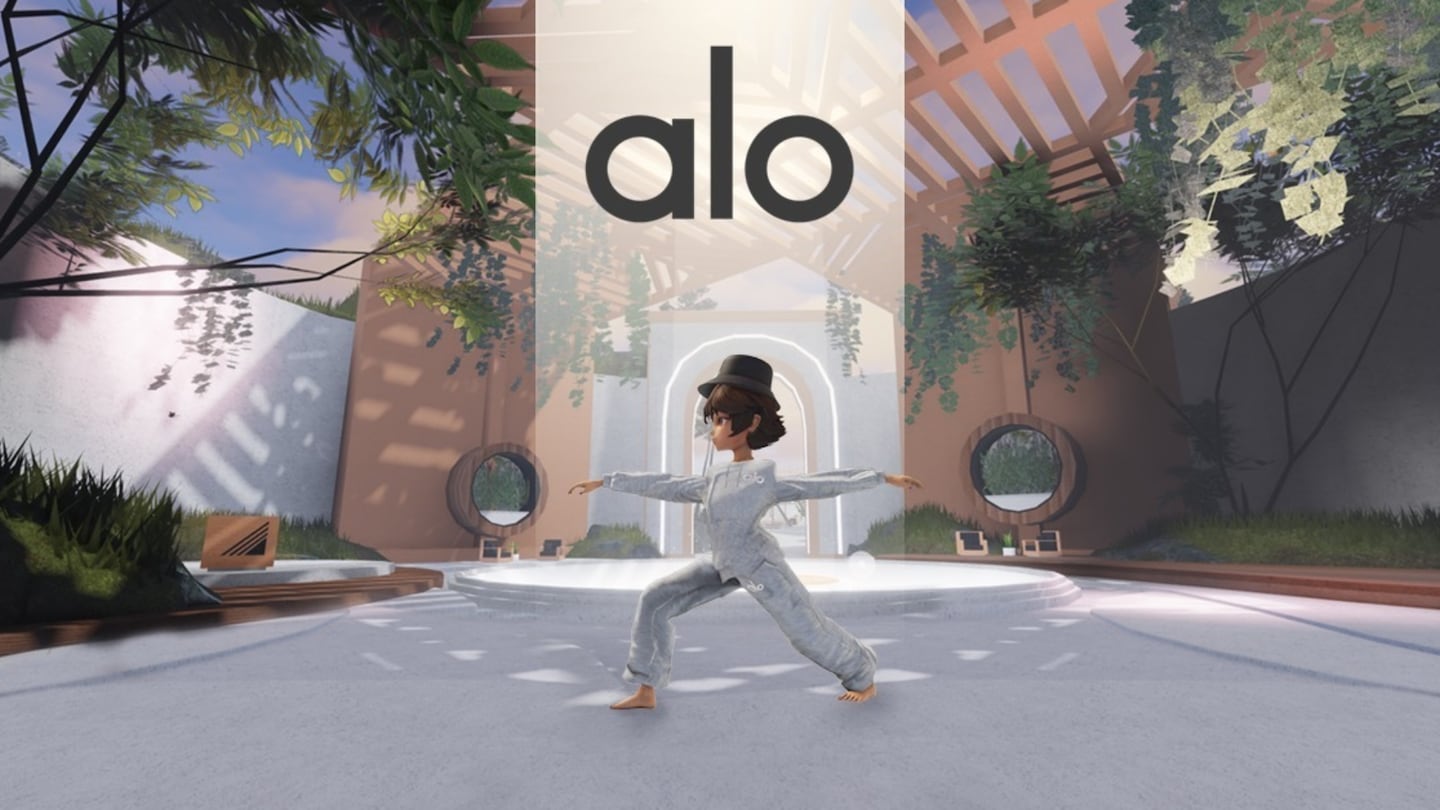

A user hopping over to Alo Sanctuary, Alo Yoga’s mindfulness-focused space in Roblox, would have a different experience. There, nearly 800 players were listed as active inside, where they could do activities like guided meditations.

Alo Yoga and Forever 21 are two out of numerous fashion and beauty brands that have rushed to capitalise on the frenzy over the so-called metaverse and web3 in the last couple years. Right now, these projects work largely as marketing, helping brands reach new audiences and connect in a way arguably deeper than an Instagram post. Their challenge now is keeping customers engaged long after the initial launch.

ADVERTISEMENT

“The metaverse hype is over,” said Charles Hambro, Geeiq’s co-founder and chief executive. “Any brand that has an objective of PR that wants to go into this space is going to be sorely disappointed.”

A handful have gone a step further, developing virtual worlds that continue to draw users. Geeiq’s data shows the Roblox games of brands such as Vans, Alo Yoga, Tommy Hilfiger and H&M receive tens of thousands of visits every day, with users collecting millions of their virtual products. Alo says more pairs of its leggings were worn in Roblox in 2022 than in real life, with nearly 2.3 million pairs redeemed and styled on the platform.

While many brands currently let players claim these items for free, their popularity, especially among Gen Z, hints at how virtual goods might one day find a place on a brand’s balance sheet. In a joint report with BoF last year, McKinsey forecast that in two to five years brands could begin to see sustained sales of virtual goods. Further out, those sales could rise to more than 5 percent of a company’s revenue.

But that can only happen if brands make digital products and experiences customers want to engage with.

Since Alo Sanctuary debuted in Feb. 2022, it’s had nearly 69 million visits and continues to see steady traffic. Where many other Roblox experiences lean into sensory overload, it aims for tranquility, embodying Alo’s emphasis on mindfulness and yoga.

Angelic Vendette, Alo’s head of marketing, attributes much of its success to this difference. Visitors can explore the world and collect tokens to trade in for items like Alo’s leggings, but they can also participate in activities like breathwork. Vendette said she’s gotten messages from several adults saying they’ll join their kids in Roblox for meditation.

The most effective branded virtual spaces tend to be those that think about the mechanics of how users interact with the space and not just the aesthetics, according to Hambro. He said the ideal response from users isn’t “this is pretty” but “I’m having a great time and I want to come back.” Games have also evolved into social spaces where players go to meet friends.

Jonathan, a Roblox user and content creator who asked not to use his full name but goes by Whose Trade on the platform, said one mistake he sees brands make is relying too heavily on free collectable items or limited editions for purchase. After users claim them, there’s little else to do.

ADVERTISEMENT

“The best ingredient to success is just engaging content for the player,” he wrote in an email. “If you can’t play your own game and have fun, then you don’t have engaging content.”

He said he’d play in Vans’ Roblox skate park, Vans World, whether or not the brand’s name was attached. On the same afternoon Forever 21′s Shop City stood vacant, Vans World, which launched in September 2021, had nearly 400 active users.

For Alo, its Roblox world immerses users in a “360 experience of what the brand stands for” and furthers its mission of bringing mindfulness to the world, according to Vendette. It doesn’t sell its virtual products at the moment, but that’s not to say there are no financial benefits.

“A ton of folks have discovered us for the first time in Roblox,” Vendette said, noting they’ll hear from users who get excited to learn an item like the Alo hat they have on their Roblox avatar is available to buy in-store. Last week, it released a new digital fashion collection on a number of gaming and social media channels, including Roblox, Zepeto, VRChat, Snapchat and The Sandbox.

Claire’s, the fashion and accessories retailer, has ambitions to turn its Roblox experience, ShimmerVille, into a direct revenue stream. It envisions a bonanza of merchandising moments based on how players are behaving within the game. It has already introduced versions of its best-selling physical items into Roblox. Soon it will start turning its most popular Roblox products into physical items to sell. This summer, for example, the popular pets users can collect in ShimmerVille will appear in stores as plush toys.

“We see gaming and what we’ve done in ShimmerVille as a long-term franchise for us as a company,” said Kristin Patrick, the company’s executive vice president and chief marketing officer. “We really are managing this much like a movie studio would.”

It’s even linking its loyalty programme so shoppers spending in its stores get in-game bonuses and vice versa, Patrick said.

For the plan to work, though, ShimmerVille needs users who want to buy associated products. To keep players coming back, Claire’s has introduced new themes and in-game quests around holidays like Christmas and Valentine’s Day. The company also plans to update key locations within the game and continue investing in popular features like the pets. To bring in new audiences, it’s enlisting brand partners. In December, it teamed with YouTuber MeganPlays, known for her Roblox videos, on a capsule collection that included physical and digital items.

ADVERTISEMENT

It can be hard to maintain consistent traffic, however. Based on Geeiq’s data, total visits to ShimmerVille have ticked down since December, though it’s still seeing several thousand visits a day. Claire’s said it hasn’t seen visits trailing off. It tracks a slightly different measure — daily active users — through a different analytics firm.

Fashion brands trying to build communities around their NFTs similarly have to keep them engaged with new perks or regular drops of new products, often while managing the community in a space such as Discord, which is a demanding job in itself. Though brands that released their NFTs during the market’s height may have already seen a payoff. One estimate from a researcher later hired by RTFKT determined brands including Nike, Dolce & Gabbana, Adidas and Gucci earned millions in revenue across the initial sales of their NFT collections and royalties on secondary sales.

Sales aren’t the only way companies can benefit from getting these digital experiences right.

Burberry’s partnership with Minecraft last year yielded a publicity boost driven largely by mentions on Instagram, according to Launchmetrics, a marketing analytics firm. It’s probably not the single most effective tool. Launchmetrics found Burberry’s Spring/Summer 2023 show produced more than three times as many posts as the Minecraft tie-up. But Alison Bringé, Launchmetrics’ CMO, pointed out there are three times as many touchpoints in the customer journey as 15 years ago and brands need to try to reach audiences in a variety of places.

Vans CMO Kristin Harrer said on a recent episode of Marketing That Matters’ “Visionairies” podcast that the company includes its Roblox world in the “brand spend” part of its portfolio, generally meaning a campaign that increases a brand’s value but doesn’t yield direct sales. What they consider is whether users are enjoying themselves and want to come back. In Harrer’s view, it’s been a success, with more than 90 million total visits and a 91-percent-positive user rating.

Direct returns on these experiments with digital worlds may not be the top priority for now. Many companies are testing the waters in hopes they can turn those learnings into sales later. Not everyone is getting it right just yet, but that’s often how it goes in emerging spaces.

“It’s still a learning experience,” Claire’s Patrick said. “If somebody tells you they’ve got it all figured out, I don’t think that’s the case.”

Vans, Balenciaga and Benefit Cosmetics are among the brands tapping the multi-billion-dollar video gaming industry with strategies aimed at generating buzz and fostering community.

The online gaming platform’s joint report with Parsons School of Design sets out the myriad opportunities for both traditional and digital designers creating for the metaverse.

Tommy Hilfiger’s livestream of its NYFW show is just the latest example of fashion courting users on the platform, which is also rolling out an immersive new advertising format for brands.

Marc Bain is Technology Correspondent at The Business of Fashion. He is based in New York and drives BoF’s coverage of technology and innovation, from start-ups to Big Tech.

Digital product passport technology could tackle counterfeiting, help brands meet regulatory requirements and unlock new sources of revenue and engagement. Michele Casucci, founder and GM of Certilogo and Robin Mellery-Pratt, BoF’s head of content strategy, gathered executives in Paris to discuss its potential.

The search giant is rebuilding its shopping experience around AI, rolling out new features like personalised product feeds and AI-powered shopping guides, beginning this week.

To boost sales and create a better customer experience, companies are revamping the e-commerce search bar to make it easier for shoppers to find products or even shop in new ways.

Concerns are growing that the technology’s transformative power has been oversold. Kamali, on the other hand, is as convinced as ever that, for her at least, it marks the start of a new creative era.