Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

MILAN – At Prada’s Spring/Summer 2024 show in Milan, the brand’s signature mashup of innovation and heritage was on full display.

A curtain of slime oozed from the ceiling, creating a striking backdrop for a collection rich in twisted glamour: a lineup of organza shift dresses harkening back to the 1920s gave off a ghostly aura thanks to vapour-light details. The gowns were punctuated by bourgeois wardrobe staples like cashmere polos — which got a punk twist from rows of metal rivets — and patchwork leather overcoats that felt both ladylike and louche.

The Prada brand is white-hot, with revenues rising 17 percent in the first half of the year despite a rocky luxury market. With sales back on track after years of sluggish growth, managing generational change is now the company’s top priority: Designer Miuccia Prada, 74, and her husband and business partner Patrizio Bertelli, 77, are gradually relinquishing control of the company. Titans of the Italian luxury industry since taking control of the brand founded by Miuccia’s grandfather in the 1980s, the pair gave up their long-held co-CEO titles earlier this year, hiring Prada’s first-ever external chief executives at both the group and brand levels.

Since 2020, Miuccia Prada has been flanked by co-artistic director, Raf Simons, her favoured successor. The brand’s September show was the last for design director Fabio Zambernardi, who is preparing to retire from the company after roughly three decades working as Mrs. Prada’s right-hand for both Prada and sister label Miu Miu.

ADVERTISEMENT

Passing the baton to the next generation at Prada—which more than any other listed luxury brand remains fuelled by the personal obsessions of its founders, will be no easy feat.

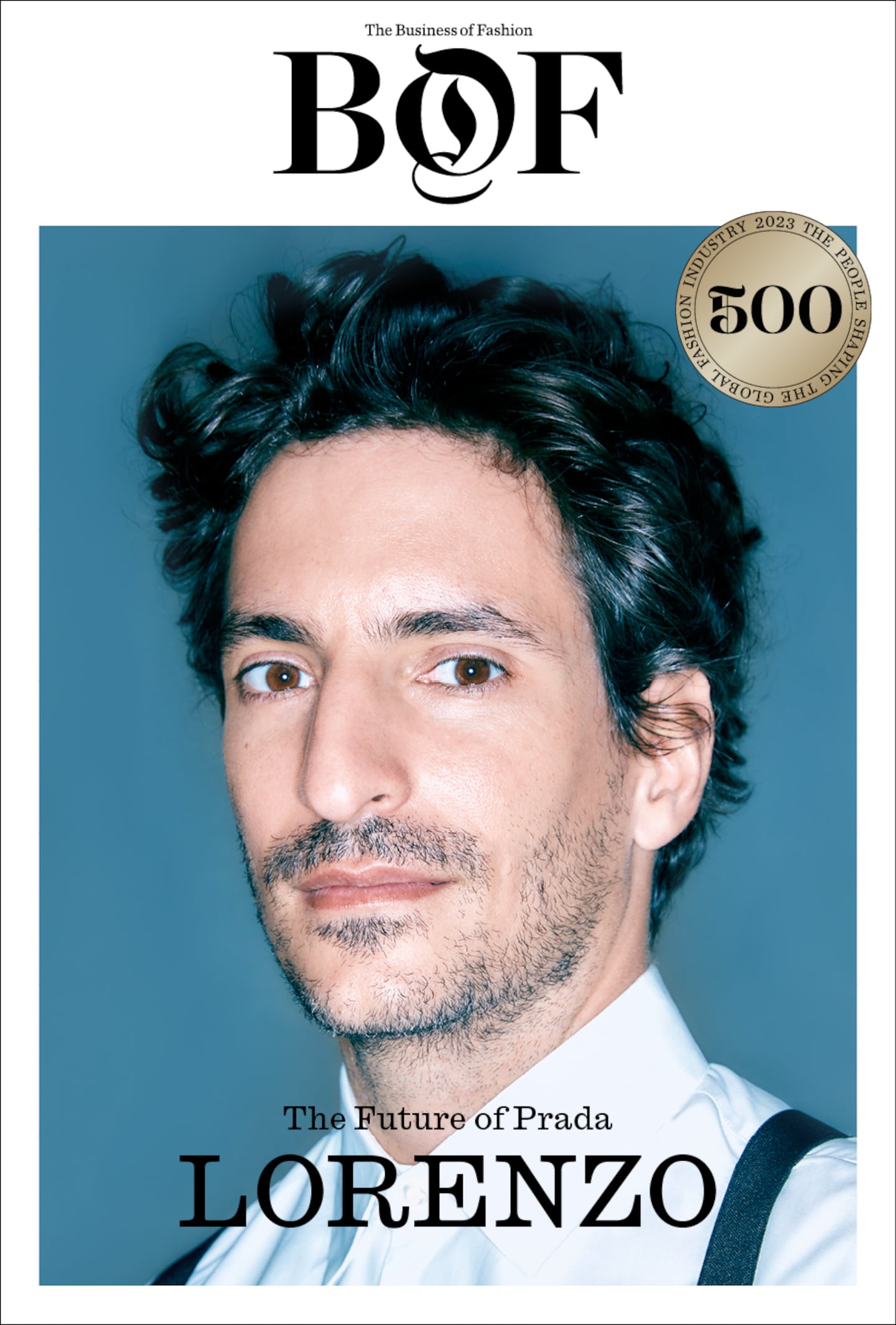

Enter Lorenzo Bertelli, Miuccia and Patrizio’s eldest son and the company’s group marketing director. As the fast-rising heir to Prada’s throne, in just a few years Bertelli has come to embody the company’s push to balance continuity with the need for evolution.

On the day of the show, Bertelli, 35, greeted celebrity guests including actress Scarlett Johansson and Korean pop singers Enhypen as cameras whirred around the runway capturing the collection from every angle.

“Everything’s changing so that everything can stay the same,” the executive told BoF in a recent interview at Prada’s art foundation, a former distillery in Milan that the family has converted into a sprawling museum, complete with a gleaming tower designed by Rem Koolhaas where the brand stages its runway shows.

An energetic 35 year-old with lively eyes and an approachable demeanour, Bertelli was unknown to the worlds of fashion and business prior to joining the company in late 2017, having dedicated most of his adult life to sport: Bertelli was a racecar driver on the rally circuit since 2010. Before that, he was mad about football, playing with ultra-competitive drive throughout his teenage years.

Longstanding efforts to revive Prada’s top line were already starting to take hold when Bertelli joined the company. Growth has since accelerated, as Bertell first worked to revamp the company’s digital communications — long a weak spot for the company — helping to revive buzz around the brand especially among young shoppers. (A move to bring back the brand’s iconic nylon accessories, albeit at a higher price point, also helped).

“I had to decide whether to start where there was already a know-how, like supply chain or retail, or start at the weakest point and put an eye on something where my parents weren’t as strong,” Bertelli explained.

The executive has since expanded his purview: In addition to joining the group’s board of directors in 2021, he now oversees all of the company’s marketing activities, as well as initiatives in technology, sustainability, and the launch of a new fine jewellery division. Bertelli has also worked closely with design and commercial teams to engineer a turnaround at Miu Miu, where a sharper marketing message and more focused collections are driving explosive sales growth (The brand’s revenues jumped over 50 percent in the first half of this year.)

ADVERTISEMENT

If the soundtrack for Hitchcock’s “Vertigo” boomed at the September show, Bertelli’s rise comes as Prada Group seeks to build on its own great heights: The company is chasing growth on top of its best-ever year in business in 2022, after a spate of buzzy collections and a pandemic surge in luxury demand finally pushed Prada above its previous high water mark from the 2010s (the flagship Galleria bag’s boom years in China). The group reported 2022 sales of €4.2 billion, of which €3.7 billion were generated in its own retail stores.

But the company is aiming to write its next chapter of growth and manage generational change at a tricky time: after post-Covid euphoria powered an unprecedented surge in revenues for top luxury brands, the market has been shaken by high inflation and a declining demand from aspirational shoppers.

The family has brought in a team of top business leaders from outside the company to act as regents, easing the transition to Lorenzo Bertelli’s intended reign. Andrea Guerra, who led eyewear giant Luxottica during its 2000s boom, has joined as group CEO, while Gianfranco D’Attis, a Swiss executive who worked at Richemont before overseeing a period of explosive growth at LVMH’s Christian Dior as president of the brand’s Americas division, has been hired as CEO at flagship Prada label.

The elder Mr. Bertelli has transitioned to an executive chairman role while owner-designer Miuccia Prada continues to serve as co-creative director alongside Simons, as well as designing Miu Miu. In the last year, the company also appointed new executives to the role of CFO, auditor, counsel, and head of people.

“Since two years it’s a completely new team,” Lorenzo Bertelli said of the executive overhaul. “The fashion industry has changed a lot. It’s like sports — you can’t just win with your talent anymore, you need a structure, an organisation.”

Bertelli’s path to the C-suite has been at once highly traditional and highly unconventional. As the eldest son in the fourth generation of Prada’s founding family, Lorenzo was the company’s prince in waiting. At the same time, he snubbed business studies, instead opting to study philosophy at the University Vita-Salute San Raffaele, a programme that attracts bright young Italians looking to avoid (or at least delay) the specialised economics programmes that most see as the path to business success.

Passionate about sports, Bertelli devoted his teenage years to soccer before becoming a racecar driver, spending nearly a decade driving in road rallies around the world.

While it’s tempting to imagine that Prada’s scion has been quietly groomed for the top job since birth, Bertelli claims his involvement in — or even awareness of — the group’s operations was minimal prior to joining the company. “It was my parents’ job, really just that,” Bertelli said.

ADVERTISEMENT

Even as he grew older and started to contemplate “taking his responsibility in the group,” he remained distanced from the company by the lengthy rally season, travelling as many as 200 days every year on a circuit that stretches from Monte Carlo in January to Japan in November.

Still, Bertelli gained skills that have served him during his rapid rise in the group. Sports taught him “to look at yourself in the mirror — really,” he says. “In sports it’s the same as in business: You compete with others, sure, but first you compete with yourself.”

His philosophy courses at the Vita-Salute San Raffaele, meanwhile, sharpened his aptitude for dialogue and resolving contradictory points of view. That’s hardly without value in a global fashion industry where top executives straddle oversight of manufacturing, retail, design and marketing across various regions every day.

“What we really lack in the world today are people who can communicate,” Bertelli said.

Despite remaining a relatively untested executive, the market has responded favourably to the younger Bertelli’s increased involvement in the group. That’s in part because he delivered swift results when he joined Prada in digital marketing, where the company had long been a laggard after years of under-investing in Instagram and snubbing influencers.

By the time of his first 2021 investor Q&A, Lorenzo Bertelli put forth action plans on key pillars like marketing, sustainability, technology and the company’s forthcoming push into fine jewellery. Markets welcomed increased involvement of Prada’s next generation.

Soon after the investor event shares rose to nearly a five-year high. Revenues soon followed: Prada reported their highest-ever sales figures last year, surpassing 4.2 billion euros.

“Lorenzo has been instrumental in driving a number of changes for the better,” analyst Luca Solca said.

“It’s very difficult to replicate the complementarities between Miuccia Prada and Patrizio Bertelli,” said Paola Cillo, director of the Luxury Management program at Milan’s Bocconi University. “Lorenzo has a philosophical training that appears to align him with [Miuccia] Prada, as well as seeming to share in some of his father’s pragmatic, hands-on business vision. He is literally their child — this is a unique trait and very interesting for the market.”

Prada reached its recent high-water mark amid surging luxury sales since the pandemic. Online brand activations had been catnip to homebound consumers during the first years of Covid-19, while fiscal stimulus, surging equities and a “YOLO” attitude prompted a shopping rush once stores and travel resumed. Prada’s sporty-chic brand image and logo-heavy merchandising with inverted triangles galore made it a natural winner.

Now, as higher interest rates and slowing economic growth strain many customers, luxury companies are racing to stave off potential brand fatigue. “Fashion is a bit tired at the present moment,” Bertelli admitted.

To stay in the conversation, luxury houses are ramping up efforts to reach potential clients via interests beyond just fashion, dialling up their marketing activities across sports, music, cinema and other facets of culture.

Prada, is in many ways the original “cultural brand,” having enriched its brand message through Mrs. Prada and Bertelli’s synthesis of cutting-edge influences going back to the 1980s. For decades, the brand has worked to generate novelty from aesthetic contradictions: juggling its Art Deco roots with signatures that celebrate Italian post-War Modernity, as well as tapping in cutting-edge contemporary creativity.

The company’s Rem Koolhaas-designed art foundation has moved the dial on Milan’s cultural scene with shows curated by art luminaries like Luc Tuymans populated with iconic works from Damien Hirst and Carsten Holler to Carravaggio. Director Wes Anderson, who was seated beside Scarlett Johansson on the front row at September’s show, designed the museum café, and has also curated shows for the foundation.

Prada’s brand identity is a perspective on things. It goes beyond fashion.

Actors like Joaquin Phoenix and John Malkovich appeared in Prada campaigns starting in the early 2000s, while Miu Miu was the first luxury brand to put actresses in the place of models. Chloë Sevigny and Uma Thurman are among those to have graced its runway before Emma Corrin debuted the look of the season for Autumn/Winter 2023: a turtleneck sweater with sequined briefs, tights, and peep-toe pumps. In the world of sport, sponsorships that have anchored the credibility of its red-tag line of sneakers and rain shells include the Luna Rossa sailing team, whose victories in competitions including the Louis Vuitton Cup won it the right to challenge for the Americas Cup, sailing’s top honour.

“Back then, no one was doing those kind of things. But Prada’s brand identity is ultimately a perspective on things — to have a vision on modernity, on culture, on sport. It goes beyond fashion.” Bertelli said.

Sketching a triangle on a napkin, Bertelli explains that decades-long efforts have positioned the brand at the very top of culture’s pyramid across a variety of domains. The brand’s challenge now will be to “stretch” that involvement to include activations that reach a wider audience without diluting the brand’s aura of insider authority.

“We have so much credibility, but a lot of people don’t know. You need to advertise it,” Bertelli said.

The company’s recent drive to boost sales of its flagship Galleria style — now fronted by actress Scarlett Johannsen — is a good example of the effort to “stretch” while still aiming for the top: Johansson’s career was initially anchored by arty flicks like “Lost in Translation” or “Match Point,” but has gone on to include blockbusters like Marvel’s “Black Widow.”

Its a marketing approach well-suited to a company that needs to sell more well-known products like perfume or nylon backpacks while still preserving the niche appeal of its ready-to-wear collections for fashion insiders: Prada is one of just a handful of luxury brands to make real money with seasonal collections, with a long roster of devoted clients who place orders in advance every season.

While Prada has added more “look at me” elements like faux-fur-coated walls, oozing slime or panopticon-like camera robots to its runways, the brand has avoided using those moments to court too much mass appeal.

“You can’t stretch the fashion part too much or you kill it — I prefer to use other tools. The fashion needs to keep a certain purity,” Bertelli said.

At its recent Milan show, Prada nailed the brief for just-edgy-enough celebrity casting: Vincent Cassel, Kylie Jenner, Spanish pop singer Rosalía, Hunter Schafer, Emma Watson, Johannson and Anderson all sat in a line. Social media engagements for the show totalled 250,000 according to analysts at Bernstein, 85 percent of those driven by much larger rival Gucci.

While many marketing chiefs increasingly seek hyper-visibility across channels throughout the year, Bertelli is wary of boring audiences with constant ubiquity. “I’m in favour of doing huge stuff… But if it’s all the time, if you have too many peaks, then it becomes just flat,” he said, drawing a sort of “buzz” chart in the air with his finger. “Contrasts are important.”

Looking ahead, Prada is hoping higher-than-ever sales will create a virtuous cycle, allowing it to invest more than ever in fuelling growth. The biggest priority, Bertelli says, will be to invest in bigger, more contemporary stores that allow it to show off the breadth of its offering, including new divisions like fine jewellery, launched in 2021, and homeware, a pet project of Bertelli père, a designer furniture fanatic who worked to relaunch the category last year.

Even with a succession plan and regency in place, whether the Prada-Bertellis might ever sell the brand or merge with another company remains a target of intense speculation.

Ultimately, despite a return to strong growth since the pandemic Prada remains in the same bind as all listed independents in the luxury goods business, where the unprecedented scale and ultra-high margins of sector-leader LVMH and its flagship brand Louis Vuitton make it increasingly difficult to compete for market share. Like other stand-alones such as Burberry, Prada faces pressure to balance investing in growth with preserving margins.

Recent moves like the refresh of its executive ranks, making the brand less founder-dependent, and exploring a second listing on the Milan Bourse — which would likely boost the company’s valuation — have left some wondering whether the family truly sees the younger Bertelli as a long-term solution, or if they are dressing the company up for a lucrative sale.

Aside from putting forward its succession plan, the family hasn’t done much to quiet speculation regarding such a possible move: In a 2021 interview, Patrizio Bertelli told BoF that remaining independent “is not the first objective we would have in mind… Eventually you can own a smaller slice of a bigger cake.”

In July, the younger Bertelli dismissed sale speculation — while preserving a just enough ambiguity too keep potential acquirers on the line: “We’re not going to sell, for now,” Lorenzo said. “Of course I mean ‘for now’ in the Italian way — it’s more of a superstition.”

The Milanese group, which also owns Miu Miu and Church’s, leveraged a partnership between Miuccia Prada and Raf Simons to generate record sales. A Thursday presentation gave investors a first peek at Prada’s future plans under new leadership.

Patrizio Bertelli and Miuccia Prada are stepping down as the group’s co-CEOs, passing the reins to former Luxottica chief Andrea Guerra and hiring a new leader for their flagship Prada brand.

Inside fashion’s most idiosyncratic, influential duo and the challenge of balancing creative complexity with a big brand’s need for clarity.

Robert Williams is Luxury Editor at the Business of Fashion. He is based in Paris and drives BoF’s coverage of the dynamic luxury fashion sector.

The FTC argued at an eight-day trial in New York that the merger would eliminate fierce head-to-head competition between the top two US handbag makers.

The Birkin bag maker reported a hefty rise in third-quarter sales on Thursday, continuing to outperform rivals hit hard by a sharp slowdown in luxury demand.

Sales at the French group fell 16 percent in the third quarter as a market-wide downturn hit hard. At flagship brand Gucci, where revenue fell 25 percent, management is exploring store closures while betting on a revamped handbag programme to jump start demand.

The tie-up between the French couture giant and the Hindi film star comes as luxury executives eye India’s high growth potential.