Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

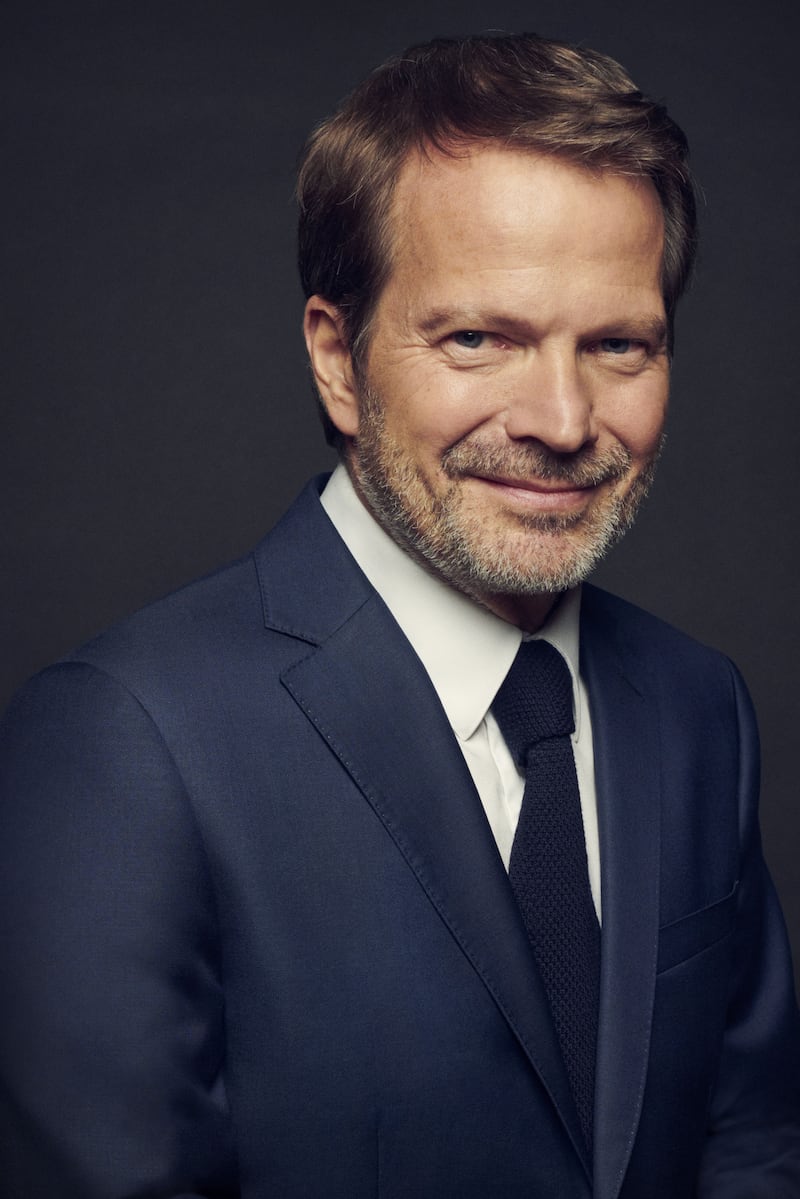

Gstaad, SWITZERLAND — Richemont-owned Piaget is bringing back one of its most celebrated timepieces in a bid to jump-start its luxury watch division and promote what chief executive Benjamin Comar describes as “visible but not vulgar” luxury.

The Polo 79 — recognisable for the yellow gold strips that run seamlessly through the watch’s case — was a well-regarded symbol of status and taste in the 1980s, worn by artist Andy Warhol, tennis champion Bjorn Borg and Swiss actress Ursula Andress.

The relaunched timepiece retains its unusual, riveted design and solid gold bracelet, but is larger than the original at 38mm in diameter. It also features a raft of contemporary technical upgrades, including the use of one of Piaget’s in-house automatic mechanical movements in place of the original battery-powered quartz.

Speaking to The Business of Fashion, CEO Comar said the $73,000 Polo 79 was “not an overstated watch or an understated watch” and that its solid yellow gold case and bracelet would appeal to the American market, where the brand is “not at the level it should be.”

ADVERTISEMENT

The US is now the biggest market for Swiss watch exports, according to the Federation of the Swiss Watch Industry, having overtaken China and Hong Kong, which dominated the market for two decades leading into the pandemic.

The Polo was originally designed in 1979 by Yves Piaget — the company’s fourth-generation leader who spearheaded the use of quartz movements to allow for ultra-thin haute joaillerie watches. It sits in a similar niche to Audemars Piguet’s Royal Oak models, which have driven explosive growth at the Piaget rival. With a similar solid gold design, but slimmer silhouette, the Polo is an opportunity for Piaget to try and capture some of these clients. The mix of industrial elements like exposed rivets with high jewellery techniques like trompe-l’oeil gadroons also give the watch unisex appeal, as watchmakers and buyers increasingly embrace the notion that most timepieces can be stylishly worn by any gender.

While the launch could generate significant buzz, its impact on Piaget’s broader business will be far from immediate: the company aims to craft an ultra-exclusive narrative around the new design by initially producing just 79 of the watches this year.

It’s less of a mystery why Piaget is bringing back the Polo 79 than why it took so long to do so. “I can’t say before me,” said Comar, who was appointed to the top job two years ago. “I’ve been yearning to do this since I joined the company.” He said the revamped watch was two years in the making and that the company had been through more than 100 designs before settling on the revamped Polo 79. The company is using the re-release to celebrate its 150th anniversary this year.

“It’s probably the most iconic watch from our company,” said Comar. “And it matches all our paradoxes: classical and yet daring, night and day, sporty and classy. And at the same time, it’s visible but not vulgar.”

Designs from a similar era have been the bread-and-butter of high-end watchmaking over the past decade. Updated editions of Audemars Piguet’s Royal Oak and Patek Philippe’s Nautilus, originally introduced in 1972 and 1976 respectively, have energised both the primary and secondary markets, while last year IWC revamped its 1976 Ingenieur SL to keep up with the trend.

Piaget, meanwhile, has differentiated itself by allowing its women’s business to lead the narrative: its campaigns more often celebrate jewellery collections like the “Possession” line or formal, feminine haute joaillerie watches like the jewel-incrusted Limelight Gala.

Piaget is betting that the Polo 79 can generate the sort of interest that would protect the company during what analysts are saying will likely be a difficult year for luxury watches. Comar admitted he is taking a “very cautious” view of the market in 2024, although he declined to comment on the brand’s performance, in line with the policy of Piaget’s parent company, Richemont.

ADVERTISEMENT

According to Richemont’s most recently quarterly report to the end of December, sales in its specialist watch division were up 3 percent year-on-year at constant exchange rates, but down 1 per cent at actual rates.

Morgan Stanley’s influential annual watch report gauging Switzerland’s top 50 watch brands suggests Piaget’s revenue fell by around 5 percent year-on-year to 265 million Swiss francs ($304 million) in 2022, during a boom in the broader Swiss watch industry. Morgan Stanley found Richemont stablemate Vacheron Constantin saw its revenue surge from 635 million Swiss francs to 825 million Swiss francs in the same period.

“We hope for the best, and we see the economics,” said Comar. “But the numbers of all the luxury groups [released in January] were good and I’m happy that the luxury market is so dynamic. Nobody expected that, not even the best analysts. The better luxury is, the better it is for everyone. We have an anniversary year and we have to be cautious, but we have a good product to start the year.”

At 38mm, the watch fits the current industry trend towards more unisex case sizes and designs, but Comar said he expected around 80 per cent of Polo 79 buyers to be men. “I see it more as a men’s watch,” he said. “But the world has changed and everybody is free to wear what they want.”

He acknowledged that yellow gold is more popular in the US, compared to Asia, where rose gold products tend to outperform. But he said the decision to make the Polo 79 in yellow gold had primarily been about respecting the original 1979 design. “The success of the original was a US success, and I think it will be the same this time,” he said.

Piaget is hoping to create an ultra-exclusive narrative around the relaunch, initially producing fewer than 100 of the Polo 79 this year. But Comar said he expected the watch to generate interest in the brand and to stimulate sales of the standard Polo, which was issued in 2016 and has since become the brand’s best-selling model. The original appeared in a variety of case shapes and sizes, but Comar said there were no plans to do the same this time around.

Piaget’s business is split roughly 50/50 between its watch and jewellery collections, but the momentum is currently stronger for jewellery, Comar said. “Post Covid, it was with watches,” he said. “But now it’s with jewellery. It changes every year, so we are happy to be in both categories.”

Higher-than-expected export figures fuelled hopes that the industry can avoid a downturn. At LVMH’s Watch Week gathering Miami, the chief executives of Bulgari, TAG Heuer, and Hublot and Zenith spoke to The Business of Fashion about adapting their strategies for an uncertain market.

High-profile collectors from sports, music and cinema have helped luxury watches shake off their dusty image and reach younger, more diverse clients. How are brands navigating the shift?

The FTC argued at an eight-day trial in New York that the merger would eliminate fierce head-to-head competition between the top two US handbag makers.

The Birkin bag maker reported a hefty rise in third-quarter sales on Thursday, continuing to outperform rivals hit hard by a sharp slowdown in luxury demand.

Sales at the French group fell 16 percent in the third quarter as a market-wide downturn hit hard. At flagship brand Gucci, where revenue fell 25 percent, management is exploring store closures while betting on a revamped handbag programme to jump start demand.

The tie-up between the French couture giant and the Hindi film star comes as luxury executives eye India’s high growth potential.