Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Opens in new window

Opens in new windowIn the aftermath of the Covid-19 pandemic, consumers around the world have embraced travel with a new fervour. Despite cost-of-living pressures and economic uncertainties, global travel flows (calculated as the total number of kilometres travelled by paying airline passengers) are projected to return to 100 percent of pre-pandemic levels in 2023 and reach between 105 percent and 110 percent in 2024, according to McKinsey analysis.

A fundamental change of lifestyles adopted in recent years is helping to fuel this rise. For example, remote and hybrid work are more entrenched than they were pre-pandemic. A growing number of workers are no longer tethered to offices. In the US, only 39 percent of companies now require staff to work from their offices full time, down from 49 percent at the start of 2023, according to workplace provider Scoop’s Flex Index, which predicts the number to fall to 15 percent in the coming years. Meanwhile, business travellers are extending their work trips into “workation” trips, a global phenomenon that combines business with leisure. Business travellers in the US, Europe and Asia take on average six “workation” trips annually, with 29 percent of these trips to international destinations, according to travel-agency specialist Travel Edge.

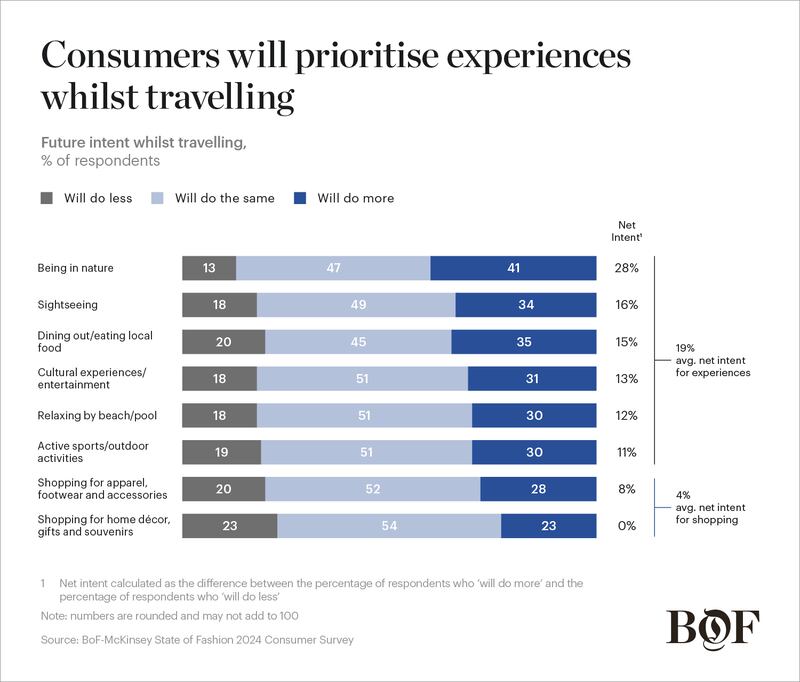

For many consumers, travelling and shopping go hand in hand. Leading players like LVMH and Kering have cited tourists, specifically Americans in Europe, as a key driver of increased sales in the first half of 2023, which grew 47 percent and 53 percent respectively. Moreover, the BoF-McKinsey State of Fashion 2024 Consumer Survey found that 80 percent of global respondents expect to shop for clothes, footwear and accessories while travelling in the year ahead, with 28 percent expecting to spend more than the previous year while travelling. For brands and retailers, these travelling consumers will provide new growth opportunities.

The world’s capital cities will remain popular for world-class shopping. Paris, for example, has seen a notable spike in tourism in 2023 with numbers approaching those in 2019. Nearly 12 million tourists visited the city between January and April 2023, representing a 27 percent year-on-year increase and only 2.5 percent down on 2019 levels. London has also seen a surge — two million more international visitors are forecast to arrive in the city in 2023, compared with the year prior.

ADVERTISEMENT

But now, many travellers are also looking to expand their itineraries beyond these traditional destinations. Over half of the respondents to the BoF-McKinsey consumer survey said they are seeking destinations they haven’t visited before in the year ahead, perhaps as a nod to a post-pandemic desire for freedom and escapism. Smaller cities like Edinburgh, Scotland; Lisbon, Portugal; or Osaka, Japan, have witnessed surging popularity this year, offering different experiences in terms of historical sightseeing, culture, local dining and nightlife as well as local shopping. “Set-jetting” destinations inspired by television and film are also resonating with travellers — consider what the series “The Game of Thrones” has done for tourism in Dubrovnik on the Adriatic coast of Croatia.

While travel itineraries are being redrawn, some brands are already adjusting where and how they connect with shoppers. In some cases, this has meant expanding store networks into second-tier cities. Uniqlo has been focusing on accelerating new openings, including plans for a store in Scotland, on Edinburgh’s Princes Street, in 2024. Edinburgh, too, has been in Chanel’s line of sight as it opened its first Scottish pop-up in the city this past summer. In other cases, it has meant capitalising on trending locations from popular culture. This is what Louis Vuitton did in Taormina, Sicily, where it opened a branded café and boutique in 2023 after the hilltop town served as the backdrop of the hit series, “The White Lotus.”

Providing differentiating experiences is also important. According to marketing agency Razorfish, 40 percent of travellers are willing to spend half or more of their travel budget on a highly curated moment or experience. While pop-ups have been part of fashion’s playbook for some time, brands are increasingly expanding these experiences into adjacent categories such as food, nature and wellness. In 2023, these have ranged from Prada’s pop-up café in London’s Harrods department store to resort-based rollouts like Fendi’s, which extended the luxury fashion brand’s aesthetics to design a beach club for the Puente Romano Beach Resort in Marbella, Spain, featuring personalised sailing boats for guests of the luxury Costa del Sol destination. Loro Piana’s La Réserve à la Plage in Saint-Tropez, France — consisting of a beach club and boutique — is another example.

And as customers’ travel itineraries expand geographically, so too will pop-up ventures. Consider Dior’s Dioriviera, which launched in 2018 to showcase the brand’s annual beach collection in a few select destinations. By summer 2023, Dioriviera had reached nearly two dozen pop-up and concept shop locations, extending beyond iconic spots such as Beverly Hills, Saint-Tropez and Capri, setting up shop further East in places like Bali and Phuket. Meanwhile, Coach launched its first Coach Airways-themed pop-up in Malacca, Malaysia featuring a concept store and café housed in a Boeing 747 jet, selling ready-to-wear, bags and travel accessories.

Fashion is also joining forces with hospitality to reimagine experiences for travellers. For example, the Four Seasons Hotel in Houston, Texas and fashion membership club Vivrelle have partnered to offer hotel guests complimentary access to an on-site luxury “closet” of brands such as Prada, Gucci and Dior. Saks Fifth Avenue has also rolled out Fifth Avenue club concepts that offer personal styling, trunk shows and special events at various Ritz-Carlton and St Regis hotels.

The new travel era also has implications for category preferences. With the BoF-McKinsey consumer survey finding that nearly 40 percent of consumers purchase new clothing to wear on their vacations, resort fashion is a key beneficiary of travel’s growth, spurring the appeal of bright, summery labels ranging from Australia’s Zimmermann to Brazil’s Farm Rio, as well as sales in the vacation category from luxury e-tailers such as MyTheresa, whose vacation category sales in 2022 were triple 2019 levels.

Luxury brands have launched or refreshed resortwear collections, often aiming to attract new customers at more accessible prices. For example, LVMH-owned Loewe — one of Lyst’s hottest brands of the year — has continued to expand its Paula’s Ibiza vacation line, riding on the success of its popular totes made from woven palm leaves. But resortwear is not just confined to luxury houses. In the mass segment, for example, Mango launched a designer collaboration in 2023 with California-based lifestyle brand Simon Miller to create a colourful capsule beachwear collection.

Beyond the collections themselves, succeeding in resortwear requires creative approaches to marketing, such as influencer trips and buzzy local activations. Recent launches of ready-to-wear lines reflecting the spirit of travel include Louis Vuitton’s LV By the Pool, with a branded activation at the iconic Zuma restaurant in Mykonos, Greece, and Versace’s La Vacanza in collaboration with musician Dua Lipa, which debuted in the south of France.

ADVERTISEMENT

For fashion executives, travel’s rebound creates an opportunity to view their global growth maps with a new lens. As their customers seek out more unique, off-the-beaten-path experiences, fashion players should consider proactively identify emerging hotspots, while innovating marketing initiatives and piloting activations that resonate with 2024′s travel zeitgeist. Partnerships with adjacent industries, such as travel adventure, hotels, spas and restaurants, can enable brands and retailers to create compelling blended experiences no matter where customers find themselves. Overall, the key will be to keep pace with global customers, adapting to when, where and how they want to shop when on the road.

This article first appeared in The State of Fashion 2024, an in-depth report on the global fashion industry, co-published by BoF and McKinsey & Company.

The eighth annual State of Fashion report by The Business of Fashion and McKinsey & Company reveals an industry navigating deep uncertainty. Download the full report to understand the 10 themes that will define the industry and the opportunities for growth in the year ahead.

The FTC argued at an eight-day trial in New York that the merger would eliminate fierce head-to-head competition between the top two US handbag makers.

The Birkin bag maker reported a hefty rise in third-quarter sales on Thursday, continuing to outperform rivals hit hard by a sharp slowdown in luxury demand.

Sales at the French group fell 16 percent in the third quarter as a market-wide downturn hit hard. At flagship brand Gucci, where revenue fell 25 percent, management is exploring store closures while betting on a revamped handbag programme to jump start demand.

The tie-up between the French couture giant and the Hindi film star comes as luxury executives eye India’s high growth potential.