Agenda-setting intelligence, analysis and advice for the global fashion community.

Agenda-setting intelligence, analysis and advice for the global fashion community.

Frasers Group is putting Matchesfashion into administration, just over two months after the retail giant acquired the struggling luxury e-tailer for £52 million ($66.6 million), The Business of Fashion has confirmed.

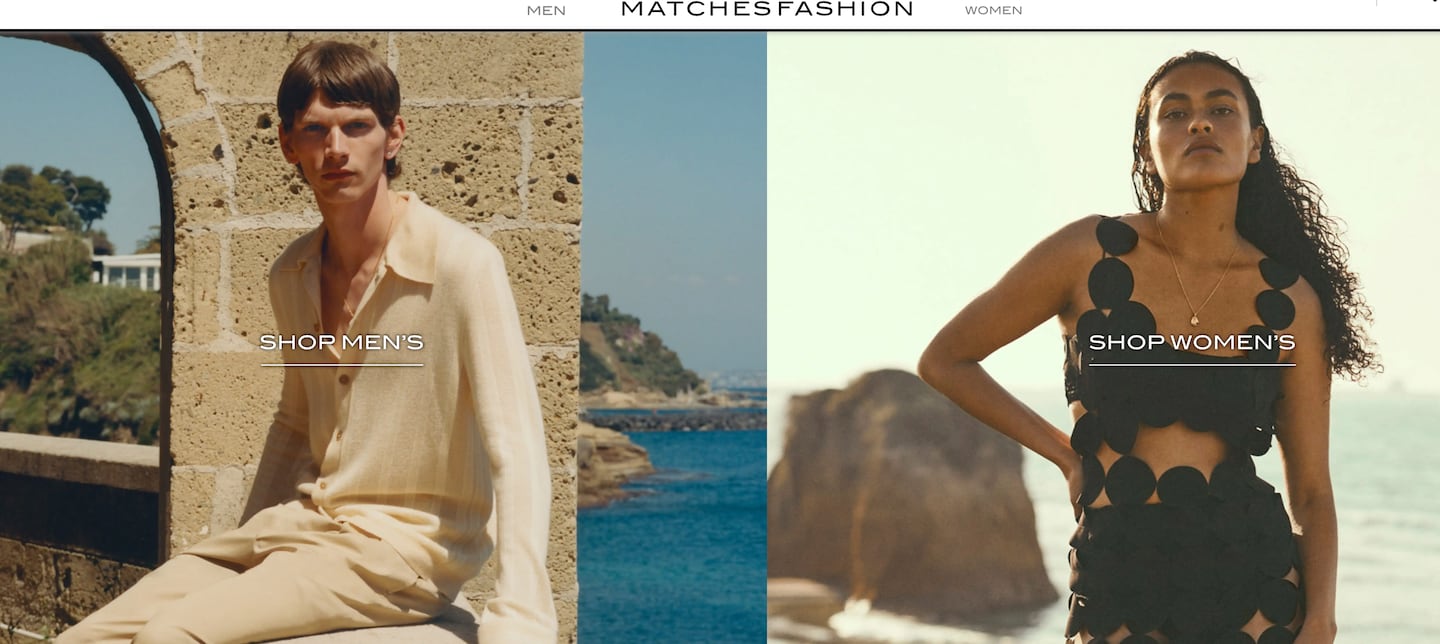

Frasers Group originally bought Matchesfashion (which rebranded to Matches late last year) to increase its position in luxury, but brands have begun to sever ties with Matches as some of them have not received payments for months, according to a report in Sky News.

“Whilst Matches’ management team has tried to find a way to stabilise the business, it has become clear that too much change would be required to restructure it, and the continued funding requirements would be far in excess of amounts that the Group considers to be viable,” Frasers Group said in a statement. “In light of this, Frasers has been informed that the directors of Matches have taken the decision to put the Matches group into administration. Frasers remains committed to the luxury market and its brand partners.”

It’s an unfortunate conclusion that was once inconceivable for Matches. Founded in the late 1980s by Tom and Ruth Chapman as a brick-and-mortar store in London, Matches was once a profitable company renowned for its curated selection of emerging brands. It eventually went online in 2007, launching a storefront and app that grew to carry more than 500 top luxury brands, including Balenciaga and Gucci.

ADVERTISEMENT

In 2017, private-equity firm Apax Partners acquired Matches at a reported $1 billion valuation, and by 2019, the company’s sales peaked at £431 million. But once the pandemic hit in 2020, Matches’ losses soon began to mount: It struggled to navigate lockdown restrictions as competition from e-commerce rivals such as Farfetch, Net-a-Porter and Mytheresa ramped up. Apax Partners also pumped millions in improving Matches’ backend operations and the user experience on the site.

Matches shuffled through four chief executives in four years before hiring former ASOS CEO Nick Beighton in 2022 to grow the business. Beighton overhauled the executive team, installing industry veterans from Farfetch and Frasers Group as chief commercial officer, chief financial officer and chief operating officer. He also increased the number of brands offered on the platform and introduced a rental service.

But those initiatives did little to improve the company’s fortunes. Matches ended fiscal 2023 with £40 million in losses on the basis of earnings before interest, taxes, depreciation and amortisation, up from £25 million in the previous year. Its sales also dropped to £380 million during the same period.

Matches’ grim ending is the most severe outcome so far of the ailing luxury e-commerce sector’s continuing woes. Retailers including Farfetch and Net-a-Porter went from industry darlings to cautionary tales as digital customer-acquisition costs ballooned and pressure to discount crippled margins. Perhaps most consequentially, luxury brands have increasingly reduced their wholesale presence as they’ve encouraged consumers to buy directly on their own e-commerce sites, putting the brands themselves in direct competition with platforms like Matches.

London-based Farfetch, which connects luxury boutiques to its marketplace and provides e-commerce software for brands and retailers, narrowly escaped bankruptcy when it was acquired by South Korean e-commerce giant Coupang last December. In February, the company’s founder, José Neves, and a cadre of other top executives exited the business. Crucial brand partners like Gucci have stopped selling on its marketplace, validating fears that Farfetch will lose value under Coupang’s ownership.

Frasers Group’s decision to shutter Matches also highlights growing impatience among investors that were once eager to pump money into luxury e-commerce. Other pioneering luxury e-tailers are at risk of suffering the same fate. Swiss luxury conglomerate Richemont attempted to sell Yoox-Net-a-Porter to Farfetch before the platform landed in its own financial troubles. The fate of YNAP, which continues to be a loss leader for Richemont, also hangs in the balance as the company continues to seek a buyer.

The sale sees owner Apax Partners take a heavy loss on the British e-tailer, recently rebranded simply Matches, amid a broader meltdown in the luxury e-commerce space.

The British luxury e-tailer reported another year of widening losses in 2021. But new chief Nick Beighton is focused on the future, looking to attract young customers and revamp the site’s user experience.

Malique Morris is Direct-to-Consumer Correspondent at The Business of Fashion. He is based in New York and covers digital-native brands and shifts in the online shopping industry.

Adidas has mounted one of the more remarkable turnarounds in recent memory after facing a crisis two years ago from the end of its Yeezy business. BoF spoke to chief executive Bjørn Gulden and other members of Adidas’ leadership to unpack how a series of bold decisions on products like its Samba sneaker, a move to refocus the brand on athletes and internal shifts brought Adidas back from the brink.

In 2024, US shoppers spent more than $14 billion online during Amazon’s 48-hour Prime Day sale. Here, Front Row’s Alexandra Carmody shares how Deal Day strategies can drive lasting success beyond immediate sales spikes.

A slew of brands should report strong results even amid an unpredictable economy and slumping luxury sales.

The dream of creating an American answer to LVMH and Kering faced a major setback this week after a federal judge championed the Federal Trade Commission’s narrow definition of the sub-luxury handbag market.